Key findings

1. Corporation tax is the fourth-biggest source of UK government revenue: the £82 billion it is expected to raise this year amounts to 8% of total government revenue. In the coming years, corporation tax revenue is forecast to reach its highest-ever share of national income.

2. For decades, UK corporation tax policy followed a broad pattern of rate cutting and base broadening. This pattern has now sharply reversed. In April 2023, the main corporation tax rate was increased from 19% to 25%. At the same time, the base was narrowed through a temporary ‘full expensing’ policy which allows companies to immediately deduct 100% of the cost of qualifying plant and machinery investments when calculating profits.

3. For now, the full-expensing policy has been put in place for three years. The government has stated a desire to make the policy permanent.

4. The design of the corporation tax base creates a range of undesirable distortions, including to the level and type of investment and to how investments are financed.

5. If the full-expensing policy ends up being temporary, it will have little or no long-run effect on the UK’s capital stock. It will bring forward some investment that would otherwise have happened later, but there is no obvious reason to want to distort the timing of investment in that way at the moment.

6. The key reason the full-expensing policy is temporary appears to be cost: the Treasury estimates an up-front cost of around £10 billion a year for each of the three years it is in place. That estimate may be correct in terms of the short-run effect on measured government revenue, but it gives a vastly inflated impression of the long-run cost of the policy. Most of the up-front cost will be recouped in future years (because full expensing is instead of a stream of capital allowances). Accounting for this, the true ultimate cost is around £1–3 billion for each year the policy is in place. There is a risk of letting short-run scorecard impacts govern long-term policy choices.

7. If full expensing is made permanent, it would bring benefits, simplifying the tax system and removing the corporation tax penalty for equity-financed investment. But, in isolation, it comes with trade-offs. Notably, it creates a bias towards investing in the kinds of assets that qualify (i.e. towards investing in plant and machinery rather than other assets), and it increases the large and problematic existing subsidy for debt-financed investment – it makes even more unprofitable projects viable. This is not good for productivity. Our view is that, on balance, making the current policy permanent would be preferable to letting it expire – though neither is ideal.

8. Ideally, the full-expensing policy would be made permanent as part of a broader reform package that extended full expensing to all investment and changed the treatment of debt interest payments. There are several ways to move towards a well-designed corporation tax base.

9. Uncertainty is bad for investment. The government – and the opposition – should set out a clear long-term plan for corporation tax.

10.1 Introduction

The 2023 Budget announced that, from April 2023 to April 2026, companies will be able to deduct 100% of qualifying plant and machinery investment immediately (known as ‘full expensing’) when calculating taxable profits. In April this year there was also a big increase in the main rate of corporation tax, from 19% to 25%; this was the first rate increase since 1973, half a century earlier.

This year therefore marks a major change in direction in corporation tax policy. Chancellors over several decades (and in most developed countries) have tended to reduce the headline rate while also broadening the base. Across the 2010s, the UK’s main corporation tax rate was cut substantially (from 28% to 19%) while the tax base was broadened, including by making most capital allowances less generous.

In February 2022 Rishi Sunak, the then Chancellor, argued that it was ‘unclear’ that recent cuts to the corporation tax rate had led to ‘a step change in business investment’1 and that increasing capital allowances would be better at promoting investment. The 2022 Spring Statement suggested various specific options for increasing capital allowances for plant and machinery investment, and a policy paper in the May sought views on them (HM Treasury, 2022). While briefly Chancellor, Kwasi Kwarteng chose to announce an increase in the generosity of the capital allowance regime in one of the specific ways suggested in the Spring Statement, setting the annual investment allowance (AIA) at £1 million on a permanent basis from April 2023 rather than allowing it to fall back to £200,000 as it had been due to.2 Temporary full expensing, which is equivalent to an unlimited AIA (for the investments it applies to), thus continues to move in the same direction.

The question facing the government (and future governments) is whether to make this full-expensing policy permanent and, if so, whether to do it alongside a broader set of reforms.

The temporary nature of the full-expensing policy is a problem. The UK needs an investment-friendly tax system for the long term, not just for the next three years. The increased generosity of capital allowances will boost business investment in the short run, but essentially by changing the timing of investment rather than its overall level. There is no good reason to distort the timing of investment at this point in time. And even the short-run impact will be limited because some large investments cannot be arranged quickly enough to be carried out within three years. The Office for Budget Responsibility (OBR) predicts that the long-run impact of the policy on the UK’s capital stock will be zero. Said differently, the policy will only have a meaningful positive impact if it is made permanent.

Making the current full-expensing policy permanent, rather than letting it expire in April 2026, would come with trade-offs. On the one hand, it would provide a simple, neutral and robust treatment of equity-financed investment in ordinary plant and machinery on a permanent basis and this would be valuable. On the other hand, the current policy is limited to (certain types of) plant and machinery, and to companies but not unincorporated businesses, meaning there would be a greater distortion to some asset choices (e.g. plant and machinery versus buildings) and across legal forms. In addition, the more generous capital allowances also interact with the treatment of financing costs to increase the subsidy for many debt-financed investments. That is not a good thing. What matters is not only how much firms invest overall, but what they invest in. Economic growth is not well served by subsidising unproductive investments that would be unviable in the absence of tax. It is difficult to weigh up the economic trade-offs involved in making the current full-expensing policy permanent. In addition, there are political economy considerations: would permanent full expensing of main-rate plant and machinery for companies make further reform more likely (e.g. by marking a clear direction of travel towards a different system) or less likely (e.g. because takeaways related to the treatment of debt finance may be harder in isolation than if accompanied by the giveaway of full expensing)? Our view is that, on balance, making the current full-expensing policy permanent would be preferable to letting the temporary measure expire, but this is a finely balanced judgement and others could reasonably take a different view. We would have much more confidence that making the full-expensing policy permanent was part of a move towards a well-designed tax base if the government had set out a plan for corporation tax.

Ideally, the full-expensing policy would be made permanent as part of broader reforms that include extending full expensing to all investment and changing the tax treatment of debt finance.

A better-designed corporation tax base would improve investment incentives. UK rates of business investment are among the lowest in the developed world; in 2019, UK business investment was the lowest in the G7 and the third-lowest in the OECD (Adam, Delestre and Nair, 2022). Higher investment in economically profitable projects would boost productivity, which would improve living standards and make meeting future challenges easier (see Chapter 3 of this Green Budget).

The government should set out a clear sense of direction and a plan for the corporation tax base. Ideally, that would involve a fully reformed base that improves investment incentives and lays down the conditions for higher and more productive business investment in the long run. But, whatever the plan, it is important that businesses know what to expect. There is clear evidence that policy uncertainty holds back investment, so should be avoided where possible. Important features of corporation tax have changed almost every year since 2010. The temporary full-expensing policy is just the latest in a long line of (often temporary) changes to capital allowances that have been put in place since 2010. This is a bad way to make policy. For any level of allowances, investment would be higher if the system were stable.

Section 10.2 describes how corporation tax affects investment incentives and how this compares with what a well-designed tax base would achieve. Section 10.3 sets out policy options. Section 10.4 concludes.

10.2 Corporation tax and investment incentives

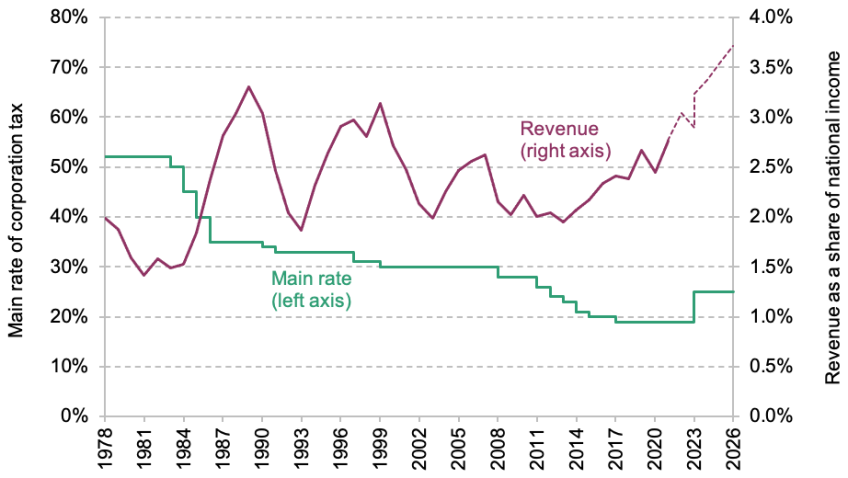

Corporation tax is the fourth-biggest source of revenue for the UK Treasury. In March 2023, it was forecast to raise around £82 billion in 2023–24, 7.8% of total government revenue. Corporation tax revenue is forecast to reach its highest-ever share of national income. In part, this is the result of the increase in the main rate from 19% to 25%. Looking back, revenues from corporation tax have been volatile, but have not declined overall despite large cuts in headline rates in the 1980s and 2010s (see Figure 10.1). This is partly because the tax base was broadened while the rate was cut (Adam, 2019).

Figure 10.1. Corporation tax rate and revenue over time

Source: https://ifs.org.uk/taxlab/taxlab-data-item/ifs-revenue-composition-spreadsheet and https://ifs.org.uk/taxlab/taxlab-data-item/ifs-fiscal-facts.

In this section, we summarise how corporation tax works. We focus on the role that capital allowances play, including how investments are treated under so-called ‘full expensing’, and how these have changed in recent years. We demonstrate how corporation tax affects investment incentives by presenting measures of effective tax rates.

How does corporation tax work?

Corporation tax is levied on the profits of companies operating in the UK. In broad terms, profit is revenue minus costs.

Deductible costs include day-to-day expenses (known as ‘current’ or ‘revenue’ expenditure), which include wages, raw materials and interest payments on borrowing.

Unlike current expenditure, investment (or capital) spending on things such as machinery and buildings is not automatically deductible when calculating taxable profits. Instead, capital allowances can be used by companies to deduct their capital expenditure from taxable profits gradually over a number of years.

Capital allowances and temporary full expensing

The capital allowances available for investment depend on the type of asset bought. Some capital allowances can be thought of as crudely allowing for depreciation, the decline in an asset’s value over time (e.g. as a result of wear and tear). Others are clearly more generous than that and can better be thought of as treating the asset purchase itself as a business expense, or as encouraging certain kinds of investment over others.

For plant and machinery, which covers everything from computers and desks to lorries, industrial equipment and other tools of the trade, but excludes cars, there are two main elements of the baseline system (i.e. the system without full expensing):

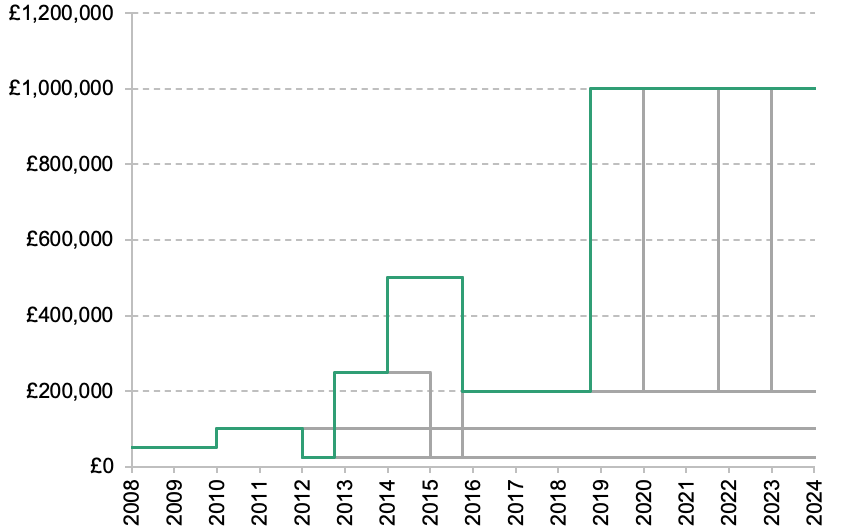

- The annual investment allowance allows (incorporated and unincorporated) businesses to deduct investment immediately up to a certain limit each year. (This is known as ‘expensing’, since firms can deduct the outlays immediately in the same way as with current expenses.) The amount that can be deducted under the AIA has varied a lot over time – and its planned level has changed even more often than the actual level (see Figure 10.2).3

Investment in excess of the AIA is deducted on a ‘declining-balance’ basis. Most assets are subject to the main rate of 18%, meaning that for each £100 of investment, taxable profits are reduced by £18 in the first year (18% of £100), £14.76 in the second year (18% of the remaining balance of £82) and so on. So-called ‘special rate assets’, which include integral features in a building (such as lifts, air conditioning and lighting systems) and assets with an expected life of at least 25 years, are subject to the same treatment but at a rate of 6%. In both cases, all of the investment spending can be deducted eventually, but the delay makes the deduction less valuable. How much less valuable depends on the market interest rate, since that is the rate of return the firm could earn (or save in debt interest) in the meantime if it received the money earlier.

Figure 10.2. The annual investment allowance over time

Note: Green line shows the actual AIA; grey lines show previous plans that did not take effect. The horizontal axis has April of each year marked; as shown in the chart, some changes took effect in January.

Source: Actual level from https://www.gov.uk/capital-allowances/annual-investment-allowance; previous plans from Office for Budget Responsibility, ‘Policy measures database’ (https://obr.uk/data/) and various Budgets and Autumn and Spring Statements.

For three years starting on 1 April 2023, companiescan fully expense (i.e. immediately write off) the full cost of main-rate plant and machinery investment. This is like an uncapped AIA in that companies can immediately write off the full investment cost. But it applies only to companies (not to unincorporated businesses, i.e. the self-employed – sole traders and partnerships) and only to investments that would qualify for the 18% main rate. Special-rate assets will receive a 50% first-year allowance over the same period.4

For most businesses, the AIA is more than enough to cover all of their plant and machinery investment.5 As such, full expensing does not change their incentives. But a small number of giant businesses account for most UK investment, and this means that most plant and machinery investment falls outside the AIA. Full expensing therefore primarily benefits this relatively small group of companies investing very large amounts in qualifying plant and machinery.6

‘Plant and machinery’ is a major asset class, but there are other assets, investment in which is subject to a range of different allowances: cars, buildings, intangible assets, assets used for research and development (R&D), and certain environmentally friendly investments7 The different tax treatment of different types of assets is undesirable; we return to this below.

The Office for National Statistics provides data on business investment, but the categories used do not map neatly onto the categories used for tax. The most recent data (for 2022) show that ‘ICT equipment and other machinery and equipment’ and ‘transport equipment’ together account for around a third of business investment. This category is closest to the definition of plant and machinery for tax purposes (but, for example, does not distinguish long-life assets or cars, both of which attract different capital allowances from other plant and machinery). ‘Intellectual property products’ account for around two-fifths of investment (but in some cases may be treated as ‘plant and machinery’ for tax purposes). Buildings and structures account for around 30% of investment. (Office for National Statistics, 2022, table 1.)

Effective tax rates and investment incentives

Corporation tax – including features such as capital allowances and the treatment of borrowing, as well as headline rates – affects the financial incentives companies face to invest.

Economic theory identifies two measures of effective tax rates that capture the effects of tax on different kinds of decision:8

- The effective average tax rate (EATR) is the proportion by which tax reduces the rate of return on an investment.

- The effective marginal tax rate (EMTR) is the proportion by which tax reduces the rate of return on a marginal investment: that is, one that is only just worthwhile. It measures how much lower the cost of capital (the rate of return investors require) would be in the absence of taxation.9 The higher the EMTR, the greater the required pre-tax rate of return, and hence the weaker is the incentive to invest.

The EMTR is therefore a special case of the EATR for a marginal investment. In short and broadly speaking, the EMTR is relevant for considering how tax affects the scale of investment that happens in the UK while the EATR is relevant for considering how tax affects the location of investment.10 Adam, Delestre and Nair (2022) provide a fuller discussion of these measures and summarise the empirical evidence on the effects of corporate taxes on investment and other business decisions. In short, there is clear evidence that tax, while not the only factor that matters, does affect where firms locate their investment projects, and how much they invest.11

Broadly speaking, a good rule of thumb is that a well-designed tax system should strive to be neutral. Neutrality means taxing similar activities similarly; neutral tax systems will tend to be simpler, fairer and have less effect on the choices that people and firms make.12 In a neutral system, the EMTR would be zero for all types of investment, regardless of legal form, source of finance, or the rates of tax, interest or inflation. The intuition is straightforward: any tax on marginal investments (those that just break even) would make such investments unviable, and worthwhile projects would not happen. (Conversely, a negative EMTR means subsidising unviable investments.) But while the EMTR would ideally be zero, the EATR would still be positive: taxing profits in excess of what is needed to compensate investors (i.e. taxing non-marginal investments) does not discourage investment.

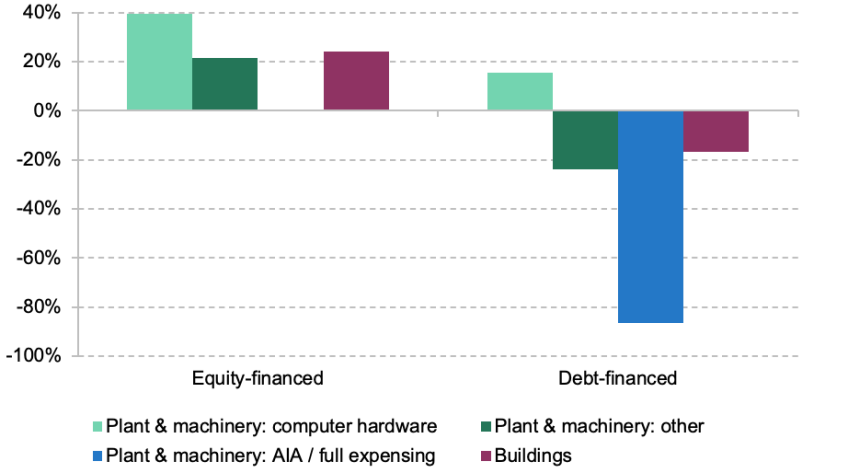

Figure 10.3 shows EMTRs for a range of different example investments under particular assumptions (see figure notes). Effective tax rates vary between assets, depending on how high capital allowances are relative to the rate at which the asset depreciates, and on the source of finance. Debt-financed investments are those financed by borrowing (e.g. a bank loan or issuing corporate bonds); equity-financed investments are those financed using shareholders’ capital (which can be money retained in a company from past profits or money newly injected by shareholders). The UK’s corporation tax base therefore distorts not only the level of investment but the choices over which assets to invest in, which legal form to use and how to finance investment. This variation will push against the efficient allocation of resources and will thereby ultimately reduce productivity, economic output and wages.

Figure 10.3. EMTRs on example investments and with different capital allowances

Note: Calculations assume a 5% real interest rate, a 2% rate of inflation, and depreciation rates of 37% for computer hardware, 12.6% for other plant and machinery, 17.5% for plant and machinery eligible for the AIA / full expensing, and 3.1% for buildings.

When equity-financed investments can be expensed (under the AIA or the temporary full-expensing policy), the EMTR is zero, meaning the tax system neither encourages nor discourages investment in that asset. The temporary full-expensing policy means that this treatment will apply to more investment (but not all).

For equity-financed investments outside the AIA or full expensing, the EMTR is positive, meaningthe tax system discourages investment: some investments that would break even before tax will be loss-making after tax. The tax disincentive will remain for plant and machinery investment above the AIA done by the self-employed and for investment in buildings, for example. The EMTR depends on the capital allowances available and on the rate of depreciation of the assets. Investment incentives therefore vary across assets. We have shown the examples of computer hardware and of other plant and machinery that we assume depreciates less quickly.13 In general, the tax system creates a bias towards investing in assets that depreciate less quickly relative to the capital allowances available for them. Since modern technology tends to depreciate more quickly than traditional machinery, this typically implies an anti-tech bias within each capital allowance category.

Effective marginal tax rates are lower for debt-financed investment than for equity-financed investment. This is because debt interest payments can be deducted from revenues when calculating taxable profits, but there is no corresponding deduction for the implicit (opportunity) cost of equity finance: the minimum return that shareholders require to persuade them to provide equity capital. Indeed, negative EMTRs for debt-financed investments mean that investment is subsidised – unprofitable investments are made viable by the tax system.14 The introduction of full expensing means that this undesirable subsidy has been extended to more investment. To give a broad sense of scale, overall around 30% of investment is financed by debt, though that varies widely across firms and sectors.15

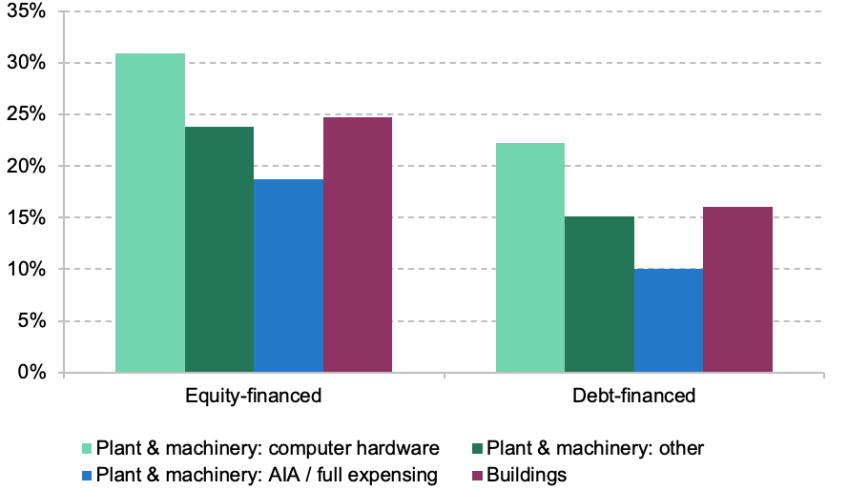

Figure 10.4 shows EATRs on example investments that are assumed to make a return of 20%. Again, temporary full expensing extends the effective rates faced by investments that qualify for the AIA to all qualifying plant and machinery. This in turn will make the UK a more attractive location for this kind of investment. Full expensingdoes not change the EATR on investment (the majority) that is not main-rate plant and machinery. (Recall from above that plant and machinery is roughly 30% of investment (though this includes things such as long-life assets and cars which get different tax treatment); another 30% of investment is in buildings and structures and around 40% is in intellectual property products.)

Figure 10.4. EATRs on example investments and with different capital allowances

Note: Calculations assume a pre-tax real return of 20%, a 5% real interest rate, a 2% rate of inflation, and depreciation rates of 37% for computer hardware, 12.6% for other plant and machinery, 17.5% for plant and machinery eligible for the AIA / full expensing, and 3.1% for buildings.

Summary: how full expensing affects problems with the corporation tax base

The design of the UK’s corporation tax base, in particular the various capital allowances and the treatment of finance costs, means that corporation tax is not neutral.16 It distorts a range of decisions for no good reason, including:

- the amount invested;

- asset choice,including choices over whether to invest in plant & machinery, buildings, cars, training, intellectual property (IP) etc., as well as choices over how long to hold onto a particular asset and when to trade it for another;

- source of finance (i.e. whether to use (new or retained) equity or debt);

- level of risk-taking;17

Such distortions hinder the efficient allocation of resources and thereby ultimately reduce productivity, economic growth and wages.

The EMTR figures above are a partial reflection of some of these distortions – effective rates vary across asset types and financing source. Adam, Delestre and Nair (2022) additionally show that effective tax rates vary with the tax rate, inflation rates and interest rates. The inefficiencies created by the tax base are worse when tax rates are higher, interest rates are higher and inflation rates are higher. All three of these factors have increased substantially in recent years. As such, the distortions created by the tax base have got worse.

The temporary full-expensing policy lessens some of these distortions but worsens others:

- It eliminates the disincentive for qualifying equity-financed investment – that is, companies’ investment in main-rate plant and machinery beyond the AIA. That is a good thing, stopping worthwhile investments being discouraged by tax.

- On the other hand, it increases the subsidy for qualifying debt-financed investment. That is a bad thing. The starting point for a well-designed system should be to ensure that tax does not affect investment decisions. There are some exceptions where subsidies may be warranted (e.g. if the investment creates value to society that is not internalised by the business doing the investment). But, more broadly, subsidies to investment are undesirable. It is possible to have too much investment. Notably, not all investments are profitable. By subsidising debt-financed investment, tax policy is encouraging investment that would be commercially unviable in the absence of tax, and full expensing exacerbates that.

- It makes the UK a more attractive location for qualifying investment.

- It does not change the treatment of investments that are already covered by the AIA, are in assets other than plant and machinery, or are done by unincorporated business.18 But the fact that full expensing applies to some investments but not others means that it increases the bias against non-qualifying investments such as buildings and many types of intangible assets.

- The temporary nature of the policy distorts the timing of investment,encouraging companies to bring forward investments that would otherwise have happened after April 2026 so that they qualify for full expensing. It is hard to see why we would want to distort the timing of investment in that way at the moment.

If the policy expires in April 2026, barely three years after it was announced, that will limit its effect on investment. Many large investments are planned many years in advance (sometimes because they have to be assessed against regulations) and could not readily be delivered on that timescale unless they were going to happen anyway. This is a key problem for temporary corporation tax measures: even if a measure ends up being in place for many years, it will have very limited or no effect on large, complex investments if the measure is not expected to last that long. Overall, the OBR expects the full expensing policy ‘to raise business investment in the three years the measure is in place by around 3 per cent when the scheme’s effect is at its peak, equivalent to around £6 billion a year’ (Office for Budget Responsibility, 2023, paragraph 3.12). However, it expects the resulting increase in the capital stock to be entirely temporary (ibid., paragraph 3.13 and box 2.2). This is partly because specific investments that are brought forward to qualify for full expensing would otherwise have happened later. In other cases, investment might be genuinely additional; but once the policy had expired, businesses would have no reason to want a higher capital stock in the long run than if the policy had never existed, so we would expect lower net investment in subsequent years (if only via depreciation of the additional assets acquired in response to the policy) and the capital stock gradually to return to the level it would otherwise have been at.

10.3 Where next for the corporation tax base?

In the 2023 Spring Budget, the government said it ‘intends to make this measure [full expensing] permanent when fiscal conditions allow’. Here we set out how (permanent) full expensing could help achieve a well-designed corporation tax base, but on its own it would exacerbate some problems while alleviating others.

We discuss some broad policy options for corporation tax base reform facing the Chancellor and the next government: extending the temporary measure; making the current full-expensing policy permanent; and making the policy permanent alongside broader reforms including extending full expensing to other investments (investment by unincorporated businesses and in other assets) and reforming the tax treatment of interest payments to remove the bias towards debt.

Full expensing as part of a well-designed tax base

It is important to evaluate policies in terms of whether they are moving towards a well-designed system. Too often, discussions of corporation tax policy – in policy papers and political debates – have not involved such first-principles thinking about what kind of corporation tax we want: they have been limited to tweaking isolated features of the system with no clear end goal beyond a general desire to increase business investment. A strategic approach is needed.

As we highlighted above, a key feature of a well-designed corporate tax base is a zero EMTR for all types of investment, regardless of the choice of asset, legal form, financing source, or the rates of tax, interest or inflation. (Justified exceptions are rare.)

There is more than one way to design a corporation tax base that achieves a zero EMTR for investments. One approach is known as a ‘cash-flow corporation tax’.19 Permanent full expensing (for all assets) is one part of this.

Full expensing creates a zero EMTR at the firm level for equity-financed investment regardless of the tax rate (provided it is expected to remain constant over time) or the rates of inflation, interest or depreciation.20 The intuition is that the company is taxed immediately on all receipts but can immediately deduct all outgoings at the same rate: with a 25% tax rate, the government covers 25% of the investment cost and takes 25% of the return, essentially becoming a compulsory silent partner in the project. If the revenue is worth more than the cost, 75% of the revenue will be worth more than 75% of the cost, so any project that is worthwhile before tax will be worthwhile after tax. That is a good thing.

To avoid distortions across asset type, full expensing (or an equivalent) would need to apply to all assets. And if all assets were subject to full expensing, there would be no need for any other capital allowances and no need to distinguish between capital and current spending. All investment costs would be deductible from profits immediately. This would remove a lot of complexity from the current system.

But full expensing in conjunction with the deduction for debt interest payments creates an undesirable subsidy for qualifying investment, the extent of which varies with rates of tax, interest and inflation. Implementing a well-designed corporation tax base therefore also requires an adjustment to the tax treatment of finance (we return to the options below).

Policy options

The corporation tax base needs reform. It creates many distortions, which are bigger at higher rates of tax, interest and inflation. There would be major benefits to moving to permanent full expensing of all assets, alongside reform to the treatment of debt interest. This points to the policy options for the government that we discuss below. We also discuss less radical options, including merely extending the current temporary full-expensing policy for an extra year or making it permanent with no other reform.

Whatever path the government chooses, there are two important factors to bear in mind.

First, uncertainty over the path of policy will hold back investment. The government should set out a clear plan.

Incentives to invest depend on expectations of future tax rules, not just on current ones. Major investments have long time horizons. If companies and investors expect the tax system to change, they will behave accordingly. And instability and uncertainty themselves will have an off-putting effect. Business groups consistently emphasise that certainty and stability in the tax system are as important as the competitiveness of the system itself.

This is particularly important in the current UK context given that the corporation tax regime has changed a lot in recent years. After years of tax rate reductions, an increase in the main rate from 19% to 25% was announced in March 2021, cancelled in September 2022 and then reinstated 21 days later, in October 2022. There has been constant change in the tax base, most notably as a result of repeated changes to the plans for the AIA. When Mr Kwarteng announced that the AIA would be set permanently at a level of £1 million, it was the ninth change to planned rates of the AIA since it was first introduced in the 2007 Budget. Alongside those changes were various other tax base changes, including, for example, to loss offsets. In 2021 there was the introduction of the so-called ‘super-deduction’ and now there is (perhaps temporary) full expensing. (And for the largest companies, this all sits alongside major changes to international aspects of corporation tax.) This constant change, in addition to the likelihood that the government will change at the next general election, does not inspire confidence that the current corporation tax base will be ‘permanent’.

Ultimately, a period of stability would be welcome. If reform is planned, what is needed is a clear sense of direction and end goal that provide a basis on which companies can plan. There is precedent for that: the 2010 Corporate Tax Road Map was widely and rightly praised. But the plan needs clear details; the 2016 Business Tax Road Map was less good.

Second, full expensing is far less expensive than it appears on the government’s five-year ‘scorecard’.

The 2023 Budget ‘scorecard’ shows the temporary full-expensing policy costing £30 billion up front – roughly £10 billion for each of the three years it is in place. This gives a vastly inflated impression of the long-run cost of the policy.

The reason is straightforward: the effect of full expensing comes almost entirely through changing the timing of tax payments. As noted above, the investment spending that firms deduct immediately under full expensing would otherwise have been gradually deducted over a longer period. When firms deduct more investment up front they will not then be deducting that investment in future years (i.e. they will pay less tax in the year they invest but correspondingly more tax in later years). Full expensing merely allows firms to deduct their investment spending earlier, and so pay tax later, than they otherwise would. The up-front exchequer cost of full expensing is recouped later. This effect can start to be seen in the scorecard for the temporary full-expensing policy. Some of the cost of the policy starts to be recouped in the final year of the forecast (2027–28): bringing forward the timing of investment and the timing of capital allowances both mean lower capital allowance claims after the expiry of the temporary policy. If the scorecard extended beyond five years, we would see that the temporary policy continued to increase government revenue in future years.21

To make this timing effect concrete, consider an example firm that invests £100. If this is subject to capital allowances of 18% a year (on a declining-balance basis), the firm will be able to deduct £18 in year one, £14.76 in year two, £12.10 in year three and so on until the investment has been written off. Under full expensing, the full £100 is offset against tax immediately. In both cases, the full investment cost is deducted for tax purposes. But under full expensing, allowances are higher in the first year (£100 rather than £18) and lower in year two (£0 rather than £14.76) and subsequently. There is a genuine cost to the exchequer and a benefit to firms of allowing costs to be deducted more quickly: tax paid earlier is more valuable to the government (and more costly to firms), because of the interest the money could earn (or save) in the meantime. For our example £100 investment, the value, in today’s terms, of the stream of 18% allowances is around £75–90 (i.e. less than the £100 value of full expensing). The exact number depends on the interest rate used to discount future payments. Said more broadly, capital allowances of 18% a year (on a declining-balance basis) – i.e. the standard allowances that apply to plant and machinery – are worth around 75–90% as much as full expensing. It is the difference between 75–90% and 100% that reflects the increased generosity and therefore the ‘true’ cost of the full-expensing policy.22

We can look through the timing of government revenue and ask: for each year’s investment, how much more generous (in today’s terms) is full expensing relative to the previous system? Given the government’s estimate of the initial revenue cost, the true cost of full expensing for each year’s investment is more like £1–3 billion for each year the policy is in place(i.e. 75–90% of the initial cost is recouped). The official scorecard costing is not therefore wrong, in the sense that it reflects what will happen to measured government revenue in the short run, but, in this case, looking at the timing of government revenues is not a good guide to the true, long-run cost of the policy.

If the full-expensing policy were made permanent, it would likewise be the case that most of the up-front cost (perhaps 75–90% in present-value terms, depending on the interest rate and the extent to which firms can make full use of available allowances) of giving full expensing for each year’s investment would be recouped in future years. So while the OBR has said that making the full-expensing policy permanent ‘could cost approaching £10 billion a year’ (Office for Budget Responsibility, 2023, paragraphs 1.25 and 3.13), this is not a good guide to the cost of the policy. The true long-run cost would be far lower, at more like £1–3 billion in today’s terms for each year’s investment. If considering the path of government revenue, the loss of government revenue each year – on average about £10 billion for the first three years of the temporary policy, according to the government – would decline over time (quite sharply at first) as a share of national income.

The analysis above just addresses the mechanical revenue effects of the reform, ignoring any effect on investment. If the introduction of full expensing led to more productive investment in the UK, that would reduce the long-run exchequer cost, as the additional revenue generated by taxing the returns to additional investment would exceed the up-front cost of giving deductions for the investment spending. In this case, the long-run cost would be even lower. However, to the extent that it led to more unproductive (e.g. subsidised debt-financed) investment, the exchequer cost would be higher.

Extend the temporary full-expensing policy for another year

The government has stated that it would like to make the full-expensing policy permanent when fiscal conditions allow. The public finances will continue to be tight (see Chapter 3 of this Green Budget). And there is no doubt a range of other policies the government would like to enact ‘when fiscal conditions allow’. Given this, and as an alternative to making the policy permanent, the government could initially extend the policy for another year, to expire in April 2027 rather than April 2026.

As with the current temporary full-expensing policy, the effect of the extension on investment would be limited. Some large investments are planned many years in advance and could not readily be brought forward to before April 2027. There would nevertheless be some additional investment in 2026–27 in response to the policy, but we would expect that that would largely be investment that would otherwise have happened later, with little long-run effect on the capital stock (for the same reasons as under the current temporary policy, discussed above). There is no obvious reason to want to distort the timing of investment in that way at the moment.

There is little value in the policy if it is temporary. Extending the policy is potentially valuable only if it is a pathway to its becoming permanent. This could be because an extension helps to signal that the government does not want the policy to expire and really does intend to make it permanent; or a series of temporary extensions, leading people to think the policy would remain in place, might make it harder for the government to let it expire.

But that is not a good way to make policy. In our view, it would be more valuable for the government to make a clear statement about its goal for corporation tax and what a pathway towards that might look like.

Make the current full-expensing policy permanent

The government could make the current full-expensing policy permanent. As discussed above, such a policy would come with a large up-front ‘scorecard’ cost, but a much smaller long-run cost.

As set out above, there are trade-offs that come with the current full-expensing policy, even if it is made permanent. Plant and machinery is a major asset class and most investment is equity-financed, so having a simple, neutral and robust treatment of equity-financed investment in plant and machinery on a permanent basis would be valuable. It could also be part of a move towards a well-designed system (i.e. if it were accompanied or followed by further policy action). But the policy does not apply to all investments, so it increases some of the distortions across different assets and different legal forms of business. It also increases the subsidy for marginal debt-financed investment. And it is possible that making full expensing permanent could make meaningful reform less likely, because it means that the government is doing much of the giveaway now and leaving the takeaways needed for fuller reform to a later date. On balance, we think a move to permanent full expensing would be preferable to letting the temporary measure expire, but it is a finely balanced judgement.

Make the full-expensing policy permanent as part of broader reform to the tax base

As discussed above, a well-designed corporate tax base could be achieved by extending full expensing to all investment and making an appropriate adjustment to the treatment of borrowing. Here we summarise what those two broader reforms would look like. In practice, there is a spectrum of choices: the government could do some but not full reform; it could phase reforms in quickly or over a long period. Unless the corporate tax base is fully reformed, different combinations of policies would come with different trade-offs.

Extend full expensing to more or all investment

The current temporary full-expensing policy does not apply to all investment: it applies only to companies, not unincorporated businesses, and only to certain kinds of assets. As a result, some investments continue to be discouraged and there are distortions across asset types and legal forms of business.

The main asset classes that do not qualify for full expensing under the temporary policy are:

- Structures and buildings, including infrastructure, which is around 30% of total business investment. There has been significant change in this area over the years. Industrial buildings allowance was gradually withdrawn between 2008 and 2011, leaving no capital allowances at all for such investment for several years; a new structures and buildings allowance was introduced for new construction and repairs from 2018 at a rate of 2% and increased to 3% in 2020. It operates on a straight-line basis, meaning that firms can deduct 3% of the investment each year for 33⅓ years. Increasing this allowance from 3% to 100% would clearly be a large change.

- Long-life plant and machinery, including features integral to a building. Outside the AIA, this can normally be deducted at 6% a year on a declining-balance basis, though during the three-year period when ordinary plant and machinery can be fully expensed (and the two-year period of the ‘super-deduction’ which preceded it), the 6% rate has been temporarily increased to 50%.

- Cars used for business. The purchase of new electric (and other zero-emission) cars can already be fully expensed, but other cars cannot; the rate of capital allowances depends on the emissions category. This is not a well-targeted policy to reduce greenhouse gas emissions from cars, as it provides an incentive for new business cars but not other cars, it makes only a crude distinction between different broad categories of car, and it provides no incentive to drive cars less once they have been bought. It would be better to treat all business cars like other assets, regardless of emissions category, and instead reduce emissions from all cars by increasing fuel duties or by making vehicle excise duty in the year a new car is purchased more strongly linked to the car’s emissions.23 For example, all business cars could be subject to the AIA, or to full expensing. However, since the government plans to ban the sale of new petrol and diesel cars from 2035, their tax treatment is becoming increasingly moot.

- Training for the self-employed. Businesses can deduct the cost of training for their employees, but the self-employed cannot deduct the cost of their own training unless it is to update existing skills rather than learn new ones. Undertaking training for work/business purposes ought in principle to be tax-deductible, although some care is needed to ensure that, for example, training in new skills is genuinely for business purposes rather than a hobby – just as caution is already needed for many other purchases that have potential private as well as business uses. Chapter 9 discusses this issue further.

- Intangible assets. This is now the single largest category of investment. It includes assets such as intellectual property, software licences, brand assets, customer lists and goodwill. Its treatment is complicated and several different rates of capital allowances (or none at all) may be available, depending on the details. The tax treatment of intangibles could be greatly simplified, and the simplest treatment of all would be to allow all of them to be fully expensed.

Extending full expensing to all investment would mean applying it to all of these asset types, and to both incorporated and unincorporated businesses. The government could also go part of the way there by:

- Applying full expensing to a wider range of investment. This could be done by, for example: extending full expensing of main-rate plant and machinery to unincorporated businesses (this would be relatively cheap given that investment by such businesses is typically low and therefore already covered by the AIA); increasing the level of the AIA (but keeping a cap); or extending full expensing (or the AIA) to more asset classes.

- Making allowances outside full expensing more generous (like the 50% first-year allowance currently in place for special-rate assets, but on a permanent basis).

More generous capital allowances are not necessarily better, for two key reasons.

First, if full expensing is extended to some assets but not others, it would remove the distortions across assets that are eligible for full expensing but increase the bias against those assets ‘left behind’. Short of applying full expensing across the board, one important criterion should be to ensure more similar treatment across assets that are closer substitutes, such as between cars and vans or between different forms of intangible assets.24

Second, on their own, any of the options for making capital allowances more generous would increase the subsidy to debt-financed investment as well as reducing the penalty for equity-financed investment, and would therefore come with a trade-off. The only way to escape that trade-off is to address the tax treatment of finance directly.

Reform the tax treatment of debt interest

A major problem with the current corporation tax base is the bias in favour of debt financing and the subsidy for most debt-financed investment. The subsidy would be increased by any increase in the generosity of capital allowances beyond the rate at which the asset depreciates, including any extension of full expensing.

Independently of whether full expensing is made permanent, the bias towards debt finance is a problem that should be addressed. Not all firms use debt despite the tax preference; the incentive (and ability) to use debt varies across firms for a variety of reasons. As noted above, on average around 30% of investment is financed by debt. But for most small, owner-managed firms, debt is zero. And for some firms, notably those involved with leveraged buyouts (when one company buys another using debt), and in some industries, such as utilities, the use of debt finance can be very high. There is empirical evidence that corporate tax leads firms to use more debt (De Mooij (2011) reviews). It is hard to quantify the economic costs of having a subsidy for debt finance, not least because not only does it distort individual firms’ financing and investment decisions but it may create a risk to financial stability. There are various channels through which high debt can cause problems for macroeconomic stability. For example, firms with higher levels of debt are more likely to fail when there is an adverse shock, such as a fall in demand that reduces cash flows and makes it harder to service a (nominal) debt (that becomes larger relative to the reduced value of assets). Through supply chains, one firm’s default can spill over to other firms. This is a key reason why excessive debt is concerning, even though it is not the major source of financing for most firms. There is empirical evidence that the build-up of debt during expansion periods tends to make subsequent recessions more likely, deeper and longer lasting (Jordà, Schularick and Taylor, 2013). Excessive leverage of financial institutions is a particular concern because bank failure creates contagion effects in the financial system and can have big adverse effects on the real economy. In the financial sector, tax policy is at direct odds with regulatory efforts to require financial institutions to hold more capital (i.e. more equity). A recent IMF report discusses these issues in detail. It concludes that ‘corporate debt bias, induced by deductibility of interest but not equity costs for the corporate income tax, remains a key [macroeconomic] stability concern’ and advises that ‘addressing debt bias should feature prominently in countries’ tax reform plans in the coming years’ (International Monetary Fund, 2016).25

There are different options for how borrowing could be treated in order to remove the distortion in favour of debt (rather than equity) financing and ensure that full expensing did not create a subsidy for economically unviable investments. These are summarised in Box 10.1.

--------------------------------------

Box 10.1. Options for the tax treatment of business borrowing

There are three possible ways to treat business borrowing that ensure that marginal (debt-financed) investments are not taxed and that tax does not affect financing decisions:

- Borrowing could be ignored completely. In practice, this amounts to ending the current tax-deductibility of interest payments (and the taxation of the corresponding interest income in the hands of lenders, typically banks or bondholders).

- Borrowing could be taxed on a cash-flow basis. The amount borrowed would be taxable and repayments of principal as well as interest would be deductible (while, symmetrically, amounts lent would be deductible and receipts of principal and interest would be taxable).

- Interest payments in excess of a ‘normal’ rate of return on the outstanding debt – that is, in excess of the interest rate on a risk-free asset such as a government bond – could be deductible (while recipients of excess interest payments would be taxed).

If all borrowing were done at the normal rate of interest, (a) and (c) would be identical, and (b) would be equivalent in present-value terms: the present value of cash inflows and outflows would be the same, netting out at zero.

In reality, loans are usually provided at above-normal interest rates; banks typically lend at higher interest rates than they offer on deposits. This ‘interest rate spread’ represents an implicit charge for financial services, through which banks cover their costs and make profits. In the hands of the bank, this charge for financial services will (rightly) be taxed as profits (after deducting any costs, such as staff wages, incurred in providing the services). In the hands of a business that takes out a loan, the charge for financial services is a business cost and, like other business costs, should be tax-deductible. An interest rate above the normal return may also reflect that a loan is deemed risky, with a chance it would never be paid back. This risk premium should also be deducted at the business level (as a cost of doing business). For these reasons, option (b) or (c) is in principle preferable to option (a) for business loans.

Option (a) does have the advantage of being simpler, however. One option would be to pursue option (a) for most businesses but have a special regime for banks and other financial firms to ensure that profits from providing financial services to households and non-taxpayers were taxed.

In practice, transitional issues and the question of how to treat transactions where one party is outside the UK would be crucial in choosing among these options.

--------------------------------------

If the UK is moving towards a cash-flow treatment of investment (by adopting full expensing in more cases), it would seem most natural to adopt a cash-flow treatment of borrowing (option (b) in the box). This would mean keeping the current interest deduction but also adding a deduction for repayments of principal and taxing all principal borrowed. But an alternative would be to modify the interest deduction so that only interest payments in excess of a normal rate of return on the outstanding loan would be deductible (option (c)). A hybrid – simply abolishing the deduction for interest payments (and taxation of interest income) for most firms (option (a)) but with a special regime for banks and other financial firms – might also be an option.

We do not discuss the pros and cons of each option in full here; nor do we discuss potential ways that the system could transition towards a different treatment of debt. We note that most countries have a bias towards debt finance, but there are a few that have moved to a different system of corporation tax (involving an ‘allowance for corporate equity’ or ACE) which largely eliminates the debt bias.26 There are also many countries (including the UK) that operate ‘thin-capitalisation rules’, which restrict interest deductibility beyond a certain amount (usually such that they only affect the largest multinational companies) and thereby affect corporate debt ratios. The International Monetary Fund (2016) discusses this and other options for limiting or removing the corporate debt bias.

10.4 Conclusion

The corporation tax base needs reform. It embeds major unwelcome distortions, and these ultimately drag on productivity, economic output and wages. The recent policy focus has tended to be on capital allowances, but the treatment of financing costs is also critical. The IMF has highlighted that the ‘corporate debt bias, induced by deductibility of interest but not equity costs for the corporate income tax, remains a key [macroeconomic] stability concern’.

Achieving an ideal corporate tax base – for example, through full expensing for all investment and a reform to the treatment of debt interest – would entail major change. It need not happen overnight. There are lots of options for moving towards a well-designed tax base. Making the full-expensing policy permanent could be one part of this. There are also various ways to make capital allowances more generous for other assets, and different options for dealing with debt.

The government has taken a step towards major reform. But if full expensing turns out to be temporary, it will have little or no long-run effect on the UK capital stock. It is not clear what the point of the policy is in that case.

The government needs a plan: a clear statement of what the end goal is. That is always important in policy, but especially for investment because of the long time horizons involved, and especially now because there has been so much change, including a sharp reversal of the direction of travel from the past four decades.

On balance, we think there is a case for making the current full-expensing policy permanent, but this judgement is far from clear-cut, and doing this reform on its own would involve trade-offs. One reason it is difficult to judge whether it would be better if the policy were made permanent is the political economy of tax changes. Fuller reform would include other giveaways (extending full expensing to other assets and to unincorporated businesses) but also takeaways (in relation to the treatment of debt). A danger is that the government is tempted to take the easy path of tax giveaways while postponing the difficult part, reforming the treatment of finance – thereby making it even more difficult than it would be as part of a balanced reform. Such a path might make it harder rather than easier to attain a good long-run goal.