Today’s elderly have much more wealth to bequeath than their predecessors, primarily as the result of rising homeownership rates and rising house prices. At the same time, today’s young adults will find it harder to accumulate wealth of their own than previous generations did, due to the sharp fall in homeownership, the dramatic decline of defined benefit pensions in the private sector and the stagnation in household incomes. Together, these trends mean inherited wealth is likely to play a more important role in determining the lifetime economic resources of younger generations, with important implications for inequality and social mobility.

Looking at current pensioners, we find that those with the highest lifetime incomes are also those who have inherited the most across the course of their lives. High-lifetime-income individuals are around twice as likely as low-income individuals to have inherited something, and many times more likely to have inherited hundreds of thousands of pounds. There is evidence that these patterns are likely to be maintained among younger generations: those with higher incomes are much more likely to either have received an inheritance or expect to receive one in future. An assessment of how inequality in the amounts inherited will differ for younger generations would require the collection of new data, but would be a worthy topic for future research.

The growing importance of inherited wealth

Elderly households now have much more wealth than households of the same age a decade ago. | Among households where all members are 80 or older, average real non-pension wealth in 2012–13 was £230,000, compared with £160,000 for the same age group in 2002–03. |

An increased proportion of elderly households intend to leave a large inheritance. | In 2012–13, 44% of elderly households expected to leave an inheritance of £150,000 or more, compared with just 24% in 2002–03. |

Younger generations are much more likely to expect to receive an inheritance than their predecessors. | Of those born in the 1970s, 75% either have received or expect to receive an inheritance, compared with 68% of those born in the 1960s, 61% of those born in the 1950s, 55% of those born in the 1940s and less than 40% of those born in the 1930s. |

Current pensioners: who inherited?

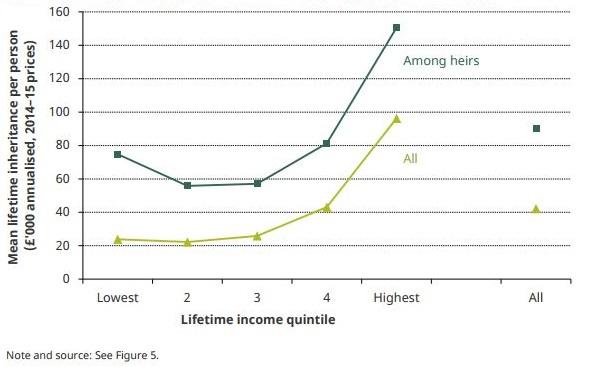

People with higher incomes over their lifetimes are also more likely to receive an inheritance. | Looking at a group of individuals born in England in the 1930s and 1940s, 64% of the highest-income fifth (top quintile) have benefited from an inheritance, compared with 32% of the lowest-income fifth (bottom quintile). |

Among heirs, those with higher incomes inherit more on average. | Looking at the same group, mean inheritance among heirs averaged £150,000 for the top quintile, but less than £100,000 for everyone else. Combined with being more likely to receive an inheritance at all, this meant the top quintile inherited four times as much on average as the bottom quintile (£100,000 compared with £25,000). |

Those with the highest lifetime incomes are much more likely to have received an extremely large inheritance. | Nearly 10% of those in the top lifetime income quintile have inherited more than £250,000, compared with around 1% of those in the bottom three quintiles. In other words, more than half of those who have inherited more than £250,000 are also in the top lifetime income quintile. |

As a proportion of lifetime income, inheritances are largest for the highest- and lowest-income individuals. | Lifetime inheritances are 4.4% of net lifetime income for the top quintile and 3.6% for the bottom quintile, compared with around 2% for the second and third lifetime income quintiles. |

These inheritances can be significant multiples of annual income from employment, particularly for low earners. | Across the group as a whole, 12% have inherited more than 5 years’ worth of net earnings and 4% have inherited more than 10 years of net earnings. But among the lowest-earning fifth, those figures rise to 16% and 9% respectively. |

Younger generations: who will inherit?

The wealth of elderly households is extremely unequally distributed. | The top half of households where all members are 80 or older hold 90% of the wealth, and the top 10% hold 40% of the wealth. Hence a ‘lucky half’ of younger households look likely to get the vast majority of the inherited wealth from the older generation. |

In younger generations, those with higher current incomes are significantly more likely to have received an inheritance or expect to receive one at some point in future. | Among those born in the 1970s, 87% of those in the top income quintile have received or expect to receive an inheritance, compared with 58% of those in the bottom income quintile. |

Inheritances have become more important for both low- and high-income households. | The poorest fifth of those born in the 1970s are more likely to have received or expect to receive an inheritance than the highest-income fifth of those born in the 1930s. |

Figure 6. Mean lifetime inheritance per person, by lifetime income quintile