In their early 30s, people born in the early 1980s have average (median) net household wealth of £27,000 per adult – including housing, financial and private pension wealth. This is about half the median wealth that those born in the 1970s had at around the same age (£53,000).

Differences in the economic circumstances of people born at different times and the role of government policy in exacerbating or mitigating those differences, have risen in prominence in recent years.The Work and Pensions Select Committee is currently conducting an inquiry into ‘intergenerational fairness’. The new Prime Minister included the fact that ‘if you’re young, you’ll find it harder than ever before to own your own home’ in a list of ‘injustices’ she intends to fight.

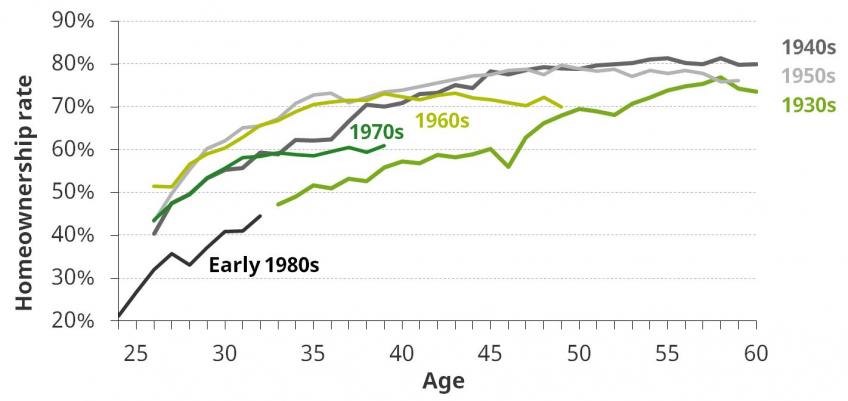

This briefing note provides an up-to-date and comprehensive picture of the incomes and wealth of different cohorts as they have moved through their lives. It is partly an update of previous work by some of the same authors, which focused on those born between the 1940s and the 1970s. The key finding of that research was that, compared with those born 10 years earlier at the same age, those born in the 1960s and 1970s have no higher takehome incomes; have saved no more of their previous take-home income; are less likely to own a home; probably have lower private pension wealth relative to their earnings; and will tend to find that their state pensions replace a smaller proportion of previous earnings. On the other hand, they expect to inherit more wealth – perhaps the main reason they could still hope to be better off than their predecessors in retirement, on average.

It looks like those born in the early 1980s are likely to find it harder than their predecessors to build up wealth in housing and pensions as they age. They have much lower home-ownership rates in early adulthood than any other post-war cohort, and – outside the public sector – have much less access to generous Defined Benefit pension schemes than previous generations did at the same age.

Other findings include:

- Those born in the early 1980s were the first post-war cohort not to enjoy higher incomes in early adulthood than those born in the previous decade. This is partly the result of the overall stagnation of working-age incomes, but it also reflects the fact that the Great Recession hit the pay and employment of young adults the hardest.

- Those born in the early 1980s have much lower home-ownership rates in early adulthood than any generation for half a century. At the age of 30, only 40% of those born in the early 1980s were owner-occupiers, compared to at least 55% of the 1940s, 1950s, 1960s and 1970s cohorts.

- In their late 20s, renters born in the early 1980s spent nearly 30% of their net income on housing costs (largely rents) on average, compared to 15% for homeowners (largely mortgage interest). At the same age, renters and homeowners born in the 1960s both spent around 20% of their income on housing costs on average. Hence, the decline in homeownership has been accompanied by a divergence in the costs paid by renters and homeowners.

- Outside of the public sector, those born since 1970 have much less access to generous Defined Benefit (DB) pensions than previous generations did. In their early 30s, less than 10% of private-sector employees born in the early 1980s were active members of a DB scheme, compared to more than 15% of those born in the 1970s and nearly 40% of those born in the 1960s. The recent introduction of ‘auto-enrolment’ means that younger cohorts have higher overall pension membership than their predecessors did but at much lower levels of generosity.

Figure. Homeownership by age, for people born in different decades

The underlying data for this briefing note can be found here.