Downloads

Accounting_for_changes_in_inequality.pdf

PDF | 2.26 MB

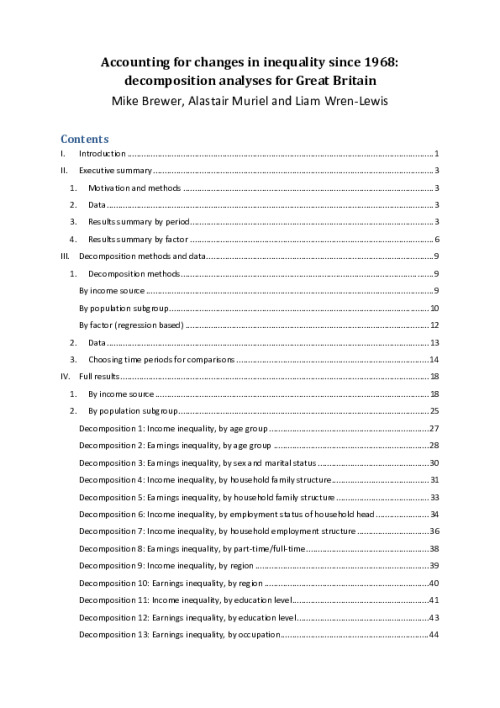

This report aims to assess the relative importance of the (many) factors influencing changes in income inequality between 1968 and 2006-07.

We assess the importance of the competing influences by decomposing changes in household income inequality, using three complementary decomposition methods:

- decomposition by income source;

- decomposition by population subgroup;

- decomposition by factor.

Because inequality in earnings (among individuals in employment) is an important source of changes in overall income inequality, we perform the second and third decompositions on individual earnings inequality, as well as on household income inequality.

Authors

Mike Brewer

Alastair Muriel

Liam Wren-Lewis

Report details

- Publisher

- Government Equalities Office

Suggested citation

M, Brewer and A, Muriel and L, Wren-Lewis . (2009). Accounting for changes in inequality since 1968: decomposition analyses for Great Britain. London: Government Equalities Office. Available at: https://ifs.org.uk/publications/accounting-changes-inequality-1968-decomposition-analyses-great-britain (accessed: 26 April 2024).

More from IFS

Understand this issue

Sure Start achieved its aims, then we threw it away

15 April 2024

Social mobility and wealth

12 December 2023

How important is the Bank of Mum and Dad?

15 December 2023

Policy analysis

Living standards since the last election

21 March 2024

Major challenges for education in Wales

21 March 2024

Sliding education results and high inequalities should prompt big rethink in Welsh education policy

21 March 2024

Academic research

Police infrastructure, police performance, and crime: Evidence from austerity cuts

24 April 2024

Labour market inequality and the changing life cycle profile of male and female wages

15 April 2024

There and back again: women’s marginal commuting costs

2 April 2024