The Augar Review – released yesterday – was wide reaching in its scope. Most importantly, the review suggests an important raft of changes to the further education sector and increases the power and scope of the post-18 education regulator, the Office for Students (as we discussed yesterday1). While these are the most significant features, there were also several changes to the student loan system that we untangle here. We confirm that the overall package of changes significantly reduces average debt while being broadly cost-neutral. It achieves that by extracting a large amount of money in future student loan repayments from middle-earning graduates.

Cuts to student debt

In all that follows we refer to student debt as shorthand for the notional amount borrowed and due for repayment as part of the student finance system. As an income contingent loan, though, this should not be thought of as “debt” in the normal sense and will be experienced by graduates as a tax on income, the only difference being that for some that tax will stop at the point at which the notional debt is paid off. This difference has indeed been emphasized by Augar, who recommends changing the communication around the student finance system to make the distinction with other loans clearer.

The review proposes three major giveaways from the government to students:

- A cut to tuition fees of £7,500

- The return of maintenance grants (for this we assume similar-sized grants to the ones that were abolished in 2015).

- A cut to interest during study, from RPI + 3% to RPI + 0%.

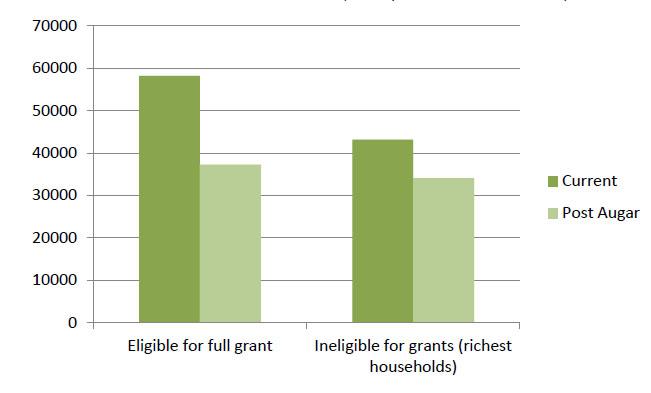

All three of the policies reduce debt on graduation, with the largest impacts felt by those eligible for the full maintenance grants. Figure 1 shows that those individuals will shave more than £20,000 from their debts on graduation, while those coming from higher income households will see their debts reduce by much less. Overall amounts owed after a three-year degree will be around £35,000 on average under the Augar system, down from around £50,000 today.

Figure 1: Projected debt on graduation from a three-year full-time degree, living away from home, outside London, with the maximum loan (2019 prices, not discounted)

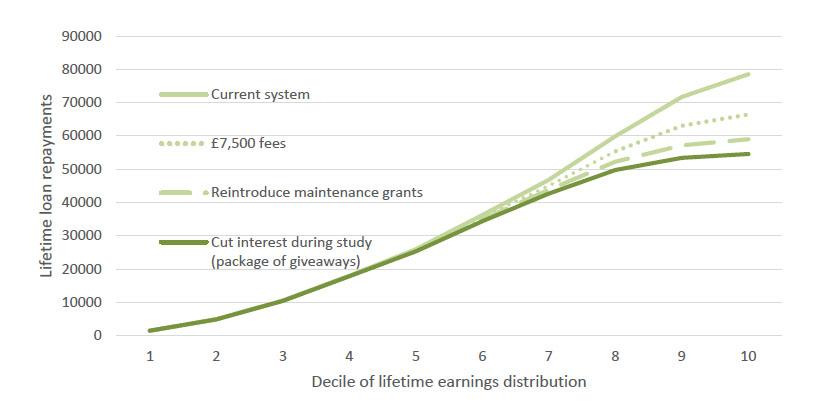

However, because of the design of the income contingent loan system, these across-the-board cuts in amounts owed do not translate into across-the-board cuts in repayments. Figure 2 shows our estimates of the lifetime repayments of graduates, in 2019 prices, modelled for the 2022 cohort, when the review proposes the new system is put into place.2 The figure shows that each of the steps represents a giveaway to the highest earning graduates. Combined, those who make it to the top 10% of the graduate lifetime earnings distribution would see their repayments reduced by more than £20,000 over the course of their lifetimes, from almost £80,000 under the current system.3

Once the cuts in fees and grants are considered, the impact of the reduction in interest during study is to reduce the repayments of the top 50% of graduates, although the gains are negligible below the top 30%. Augar states that slashing interest altogether was seriously considered, but ultimately it was decided that the cost was simply too high. We estimate that combined, the long term government cost of the three recommended giveaways is around £1.5 billion per year.4 Cutting interest rates to just RPI for the whole term of the loan, as opposed to solely during university as recommended in the review, would add a further £1.1 billion to that cost, and again it would be high earning graduates who benefit most.

Figure 2: Distribution of lifetime repayments of graduates (2019 prices, not discounted)

Changes to the student loan repayment rules

The £1.5 billion of giveaways to HE, combined with additional giveaways to FE meant Augar had to save money from somewhere in order to stay within his remit. His solutions were:

- A cut to the repayment threshold (i.e. the point at which people start making repayments on their loans) from £25,000 to £23,000 in today’s money.

- An increase in the repayment term from 30 to 40 years.

The new threshold is to be set equal to the median of non-graduate earnings, rather than the rather arbitrarily chosen £25,000. The increase in the repayment term brings the design of the English income contingent loan closer to those in Australia and New Zealand, where debt is written off upon death (in fact, in Australia there have been several calls to go even further and extract outstanding loans from inheritances).

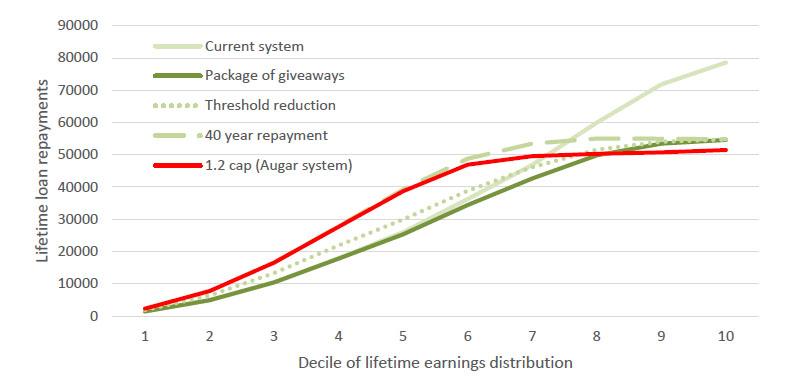

Figure 3 shows the estimated impact of these two changes on the distribution of lifetime repayments (green dotted and green dashed lines). The changes both increase repayments of those in the middle of the distribution, without having much impact on the lifetime repayments of those at the bottom (whose earnings are two low) or at the top (who repay anyway). While the threshold reduction does not affect the lifetime repayments of the top earners, it does bring their repayments forward, which means they repay their loans slightly more quickly.

The final change recommended by Augar was a repayment cap equal to 1.2 times the value of the loan. This was intended to address concerns that the extension to the repayment period combined with the positive real interest rate would result in higher earning graduates (who repay more quickly, and hence incur less interest) repaying less than middle earning graduates.

Figure 3: Distribution of lifetime repayments of graduates (2019 prices, not discounted)

Our model actually suggests that on average, the “regressivity” of the system is not a significant problem (repayment of people in the 8th decile are only a fraction higher than those in the 10th) without the repayment cap, although it is true that it happens more at the very top of the distribution (for example between the 95th and 99th percentiles). Most pertinently, we observe that the repayment cap is another (quite expensive) giveaway to higher earning graduates, with the top 40% seeing reductions in their lifetime repayments.

Between the current system and the final Augar system, we see that the changes are most beneficial to the highest earning graduates while hitting middle earners. Those at the top of the graduate lifetime earnings distribution see reductions in their repayments of around £30,000 in today’s money, while those in the middle see increases of around £15,000. The biggest beneficiaries are those in the top 10% of lifetime earners who grew up in households with incomes low enough for them to qualify for the full maintenance grant; those people can expect to see reductions in lifetime repayments of approximately £40,000.

Summary of the overall costs

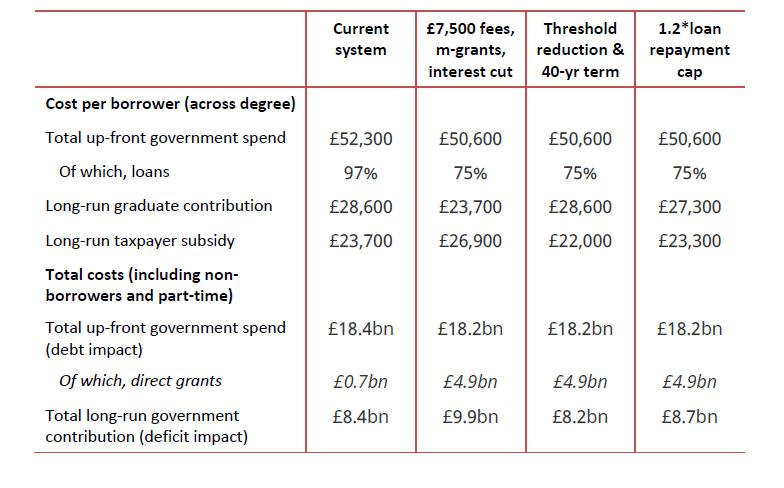

Figure 4 summarises our overall estimates of the changes in terms of per-borrower and overall cost to government for the 2022/23 cohort of university students. We observe that up-front spending per borrower stays broadly constant through the changes, with the decline due to freeze in nominal spending until 2022/23 (assuming spending on the current system would go up in nominal terms, which might be considered unlikely).

However, importantly, the share of that up-front spending made up of loans falls substantially from 97% to 75% as part of the loans are replaced by teaching grants and maintenance grants. Lower spending on loans “frees up” around £4 billion for up front spending. Augar allocates around half of it to maintenance grants for students from poorer households, and the other half to top up teaching grants for courses to be determined by the regulator.

Figure 4: Summary of per-student and overall costs of the system for the 2022/23 cohort, sequential changes to the system (2019 prices, future student repayments discounted at 0.7% + RPI)

Our estimates suggest that the Augar proposals do reduce per-borrower spending by around £400 per borrower (to £23,300) compared to the current system, or roughly £140 million across all borrowers. However, once the 10% of non-borrowers – who all benefit considerably from the fee cuts, and may benefit from maintenance grants – are taken into account, the overall package is around £300 million more expensive. This (thanks to the recent ONS review) long-run cost is also approximately equal to the annual deficit impact of higher education.

Crucially, the estimates here are highly sensitive to assumptions future inflation, earnings growth, and indeed some precise details of the policy implementation. They should therefore be thought of as being broadly cost-neutral, and not dramatically different to those published in the review.

Summary

Overall the package of changes results in reduced payments for high earners, while middle earners see significant increases in repayments. The changes make the system considerably less “leaky”, with roughly 50% of graduates expecting to fully pay-off their loans under the Augar model, compared to less than 20% under the current system.

However, it is crucial to remember that the review is not simply tinkering with the loan system without good reason, and these changes are part of a wider package. They are close to being cost-neutral for government, while delivering two potentially significant improvements to the system. First, they dramatically cut the debts incurred by those going to university who come from poorer backgrounds. Second, they are a move back from the marketisation of the system and towards more tight regulation that will sharpen the teeth of the Office for Students. If done well, this could enable the regulator to ensure the system is providing value for money and operate in harmony with the further education sector as it should.

1 See https://www.ifs.org.uk/publications/14135

2 We assume the composition of graduates will be unchanged between now and 2022. The figures are in 2019 prices.

3 This figure is of course much lower if we choose to discount the future, which this does not.

4 Here, the long run cost is equal to the (discounted present value) of lost student loan repayments. Our estimate of £1.5 billion is slightly higher than the £1.3 billion we reported here because it is based on full implementation occurring in 2022/23 rather than this year (as Augar intends). We assume that the current system would start to increase in nominal terms from 2020, while Augar outlines that the new system should be fixed in nominal terms until 2022.

NOTES

We have assumed a maximum maintenance grant equal in magnitude (in real terms) to those abolished in 2015, as the review is vague on the specific numbers (stating they should be “at least” £3,000). All grants are in place of, rather than on top of loans.

Figure 1: this compares debt on graduation for someone starting university in 2018 under the current system vs. someone starting university in 2022 under the Augar system, all in 2019 prices, not discounted.

Figure 4: we assume non take-up of loans of 10% for full and part time students. We do not include the roughly 30,000 EU students (who are eligible for tuition loans only) or the 90,000 students studying “other” higher education degrees rather than “first degrees” due to insufficient data on the outcomes of both. Both will add to the overall cost, although in both cases the per borrower cost will be considerably lower. We have assumed around 350,000 full time and 40,000 part-time students which are based on today’s numbers. Of course, increases in student numbers between now and 2022 would add to the long-run cost, though the number of 18 year olds are projected to be roughly the same between now and 2022.