The decline in the homeownership rate of young adults in Great Britain is an issue that has risen to the top of the political agenda. In this briefing note, we provide up-to-date analysis of falls in homeownership, and which groups of young adults have seen the sharpest falls.

We then shed new light on this phenomenon in two ways. First, we look at how the relationship between the incomes of young adults and house prices in their region has evolved over the past twenty years, and ascertain the extent to which the rise in regional house prices relative to incomes can explain the fall in homeownership among young adults. Second, we look at how the homeownership rates of young adults relate to the occupational class of their parents, and in particular the extent to which parental characteristics are related to the homeownership rates of children over and above intergenerational links in earnings, education and occupation.

Key findings

- Today’s young adults are significantly less likely to own a home at a given age than those born only five or ten years earlier. At the age of 27, those born in the late 1980s had a homeownership rate of 25%, compared with 33% for those born five years earlier (in the early 1980s) and 43% for those born ten years earlier (in the late 1970s).

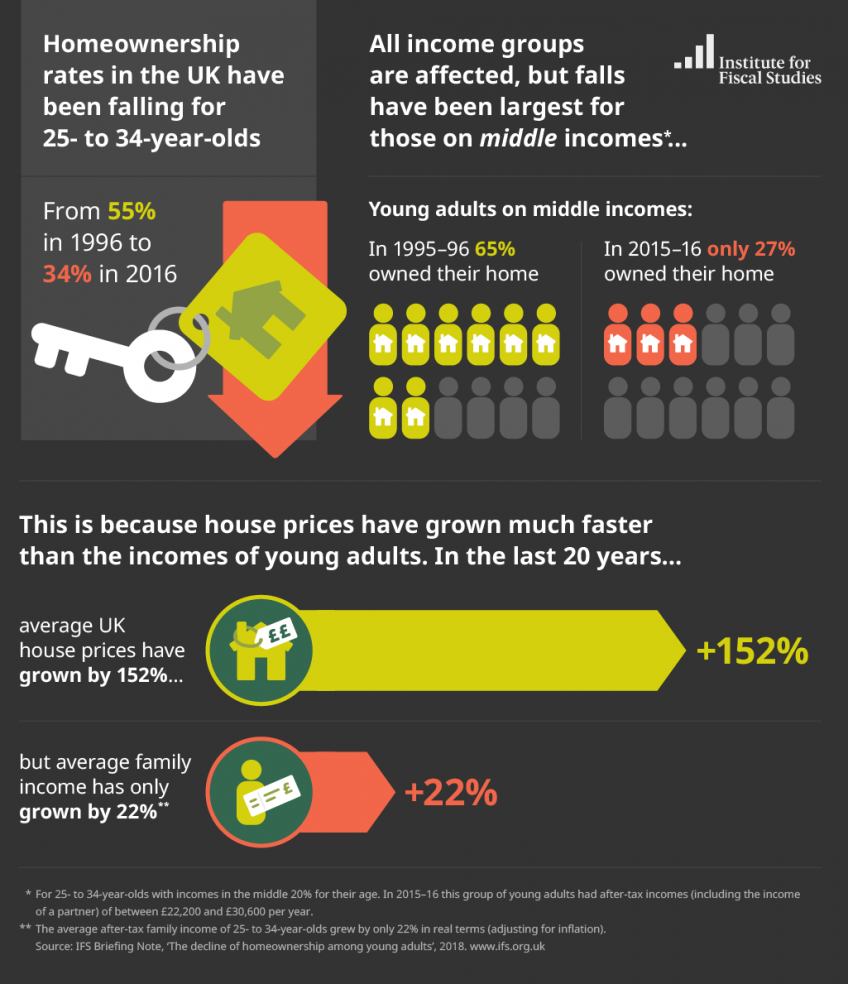

- The falls in homeownership have been sharpest for young adults with middle incomes. In 1995–96, 65% of those aged 25–34 with incomes in the middle 20% for their age owned their own home. Twenty years later, that figure was just 27%.

- The key reason for the decline is the sharp rise in house prices relative to incomes. Mean house prices were 152% higher in 2015–16 than in 1995–96 after adjusting for inflation. By contrast, the real net family incomes of those aged 25–34 grew by only 22% over the same twenty years. As a result, the average (median) ratio between the average house price in the region where a young adult lives and their annual net family income doubled from 4 to 8, with all of the increase occurring by 2007–08.

- This increase in house prices relative to family incomes fully explains the fall in homeownership for young adults. The likelihood of a young adult owning their own home given how their income compares with house prices in their region is little changed from twenty years ago. But in 2015–16 almost 90% of 25- to 34-year-olds faced average regional house prices of at least four times their income , compared with less than half twenty years earlier. At the same time, 38% faced a house-price-to-income ratio of over 10, compared with just 9% twenty years ago.

- Young adults from more disadvantaged backgrounds are less likely to own their home, even after controlling for the kind of job they have and other characteristics. In 2014–17, 30% of 25- to 34-year-olds whose parents were in a low occupational class (e.g. delivery drivers or sales assistants) owned their home, compared with 43% of those whose parents were in a high occupational class (e.g. lawyers, teachers or estate agents). However, after controlling for differences in observable characteristics of young adults such as their earnings and education, the homeownership gap between those from high and low socio-economic backgrounds is much smaller, at around 3 percentage points.