Rachel Reeves, the Shadow Chancellor, promised in September 2021 that a Labour government would deliver ‘an additional £28 billion of capital investment’ each year to support the UK’s transition to net zero. In June of this year, Ms Reeves reaffirmed her commitment to this pledge – dubbed a ‘Green Prosperity Plan’ – but removed the word ‘additional’ and indicated that the investment would be ramped up over time, reaching £28 billion per year only by the second half of the next parliament. Here, we analyse the specifics of this major spending pledge and draw four conclusions.

First, Labour’s £28-billion-a-year plan might be more accurately described as a £20-billion-a-year plan. Second, Labour’s plans – if delivered – would mean high levels of investment by recent UK standards, but would still leave investment on a falling path over the next parliament. Third, the decision to ramp up spending over time, rather than aim to spend an additional £20 billion from year 1, is a sensible one. And fourth, the specific size of the package and its timing are far less important than the specifics of what it would be spent on and how well it would be spent.

Labour’s ‘Green Prosperity Plan’

As part of its ‘Green Prosperity Plan’, the Labour Party is committed to investing £28 billion a year towards the UK’s green transition. The plan is to be investing a total of £28 billion a year in the second half of the parliament ‘at the latest’. The pledge is defined in nominal (cash) terms; if expressed in terms of today’s prices, it would be less than £28 billion.

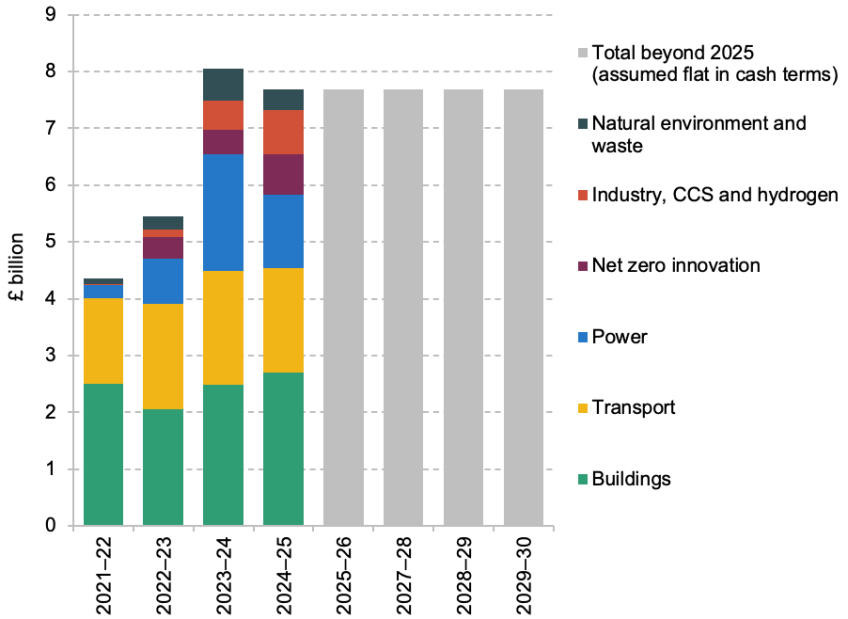

While the original framing of the policy suggested that the entirety of this would be ‘additional’ spending, Labour have since clarified that emissions-reducing spending announced by the government in the interim – most notably at the October 2021 Spending Review – would also count towards the £28 billion total. There is around £8 billion of such spending pencilled in for 2024–25 (the final year for which detailed plans exist). This is broken down in detail in Figure 1. If we assume that these spending items will be frozen in cash terms beyond 2024–25 (in line with the current government’s stated plans for overall capital spending), that implies around £8 billion of green investment each year that Labour would treat as already in the baseline for the next parliament. To spend £28 billion per year on the green transition therefore requires ‘only’ £20 billion to be added to existing plans.

Figure 1. Emissions-reducing spending in the October 2021 Spending Review

Source: Table B in chapter 3 of Office for Budget Responsibility’s October 2021 Economic and Fiscal Outlook.

This should not be interpreted as a criticism. If Jeremy Hunt, the current Chancellor, decided to add £28 billion to his investment plans at the next Budget, it would be silly for Labour to decide that the ‘right’ amount of green investment suddenly becomes £56 billion. In other words, although £28 billion is itself an arbitrary figure, it would be far more arbitrary for Labour’s policy to be ‘whatever the government says it will spend, plus £28 billion’. It does matter, though, when assessing the likely impact on overall levels of investment – the issue to which we now turn.

The estimated impact on overall levels of government investment

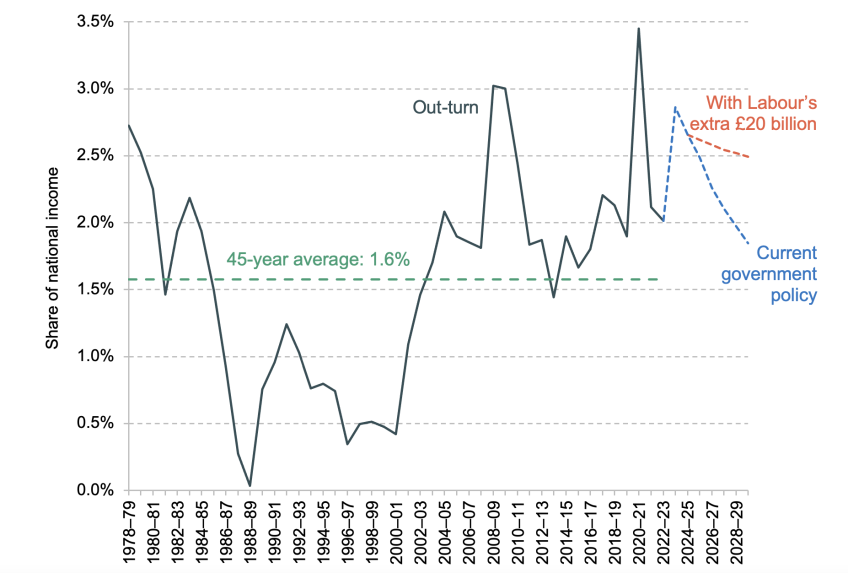

Labour’s plan – as currently stated – is to spend an additional £20 billion per year, relative to the government’s current plans, by the second half of the next parliament. Figure 2 shows what this would mean for the overall level of public sector net investment (PSNI) as a percentage of national income (the note to the figure outlines the assumptions we have made to produce such an estimate). There are four key things to take away.

Figure 2. Estimated path for public sector net investment under alternative scenarios

Note: Assumes that a Labour government increases public sector net investment (PSNI) by £20.3 billion in 2029–30, relative to an estimated baseline consistent with current stated government policy (which includes an estimated £7.7 billion of emissions-reducing spending in each year from 2024–25 onwards, taking total ‘green investment’ in 2029–30 to £28 billion). We additionally assume that the additional investment is scaled up such that PSNI grows at a constant nominal rate between 2024–25 and 2029–30, and allow for a demand boost to GDP from higher net investment spending. The ‘current government policy’ line assumes that public sector gross investment (PSGI) continues to be frozen in cash terms beyond 2027–28 (the final year for which published plans exist) and that public sector depreciation continues to grow beyond 2027–28 in line with the average annual growth rate forecast between 2022–23 and 2027–28. Nominal GDP is assumed to grow beyond 2027–28 at the average annual rate forecast between 2022–23 and 2027–28.

Source: Author’s calculations using Office for Budget Responsibility’s Public Finances Databank, October 2021 Economic and Fiscal Outlook and March 2023 Economic and Fiscal Outlook.

First, the plans that an incoming Labour government would inherit imply a steady reduction in investment as a share of national income over the course of the next parliament. Current government policy is for capital investment to increase sharply in 2022–23 and 2023–24 (driven mostly by increases in departmental capital budgets, with a notably large increase for the Ministry of Defence) and then to be frozen in cash terms until 2027–28. Public sector net investment is defined as public sector gross investment (PSGI) minus depreciation (the reduction in asset values due to things such as wear and tear). The cash freeze in PSGI (which we assume extends to 2029–30), combined with a growing economy and expected increases in depreciation, translates into declining levels of net investment as a percentage of national income over time. This is shown by the dashed blue line in Figure 2.

Second, Labour’s plans for an extra £20 billion of investment spending by the second half of the parliament (which we interpret as meaning by 2029–30) would result in high levels of public investment by recent UK standards. Over the 45 years from 1978–79 to 2022–23, PSNI averaged 1.6% of national income. Under our estimates, Labour’s plans would see PSNI average 2.6% of national income over the next five-year parliament: some 60% higher than the recent historical average, and close to the average between 2020–21 and 2024–25 (which includes a large spike during the COVID-19 pandemic, when national income was depressed). Under the current Conservative government’s plans, we estimate that PSNI would average 2.2% of national income over the next parliament: considerably lower than would be the case under a Labour government, but still above the historical average.

Third, the additional £20 billion per year would not – under our estimates – be enough to stop PSNI falling as a fraction of national income from 2025–26 onwards. Government investment would likely be lower as a percentage of national income at the end of the first term of an incoming Labour government than at the start, even with Labour’s ‘Green Prosperity Plan’. Under current Conservative plans, investment spending would fall by more.

Fourth, current policy is for overall capital spending to be held more or less flat in cash terms after 2023–24. The additional investment promised by Labour is all earmarked for ‘green’ projects which support the UK’s transition to net zero. This implies that even under Labour, non-green investment would be frozen in cash terms. In other words, both parties’ plans imply a real-terms squeeze on other areas of public investment.

It should be stressed that these are estimates, and ones that are sensitive to the assumptions underpinning them. As we get closer to the election, the Labour Party may update its policy and/or provide more detail of its plans for aggregate capital investment as part of its broader fiscal offer to the electorate. The current government, too, might update or flesh out its plans. These projections should not, therefore, be treated as ‘final’, but as an illustration of what Labour policy (as currently stated) could mean for aggregate investment.

The quality of spend matters too

In June 2023, Rachel Reeves wrote that ‘to meet our fiscal rules, as well as to make sure there is time to build the supply chains we need, skill our workforce, and ensure the taxpayer gets value for money, the right way to deliver our Green Prosperity Plan is to ramp up the investment over time’.

This is sensible. Any government seeking to increase investment by £20 billion overnight would struggle to do so without enormous amounts of waste. In all likelihood, large sums would go unspent. Historical experience shows that governments of all political stripes have tended to undershoot their capital spending plans. The Office for Budget Responsibility (OBR) routinely assumes that 20% of any newly announced capital spending will go unspent, for this reason. It is therefore quite possible that if a new Labour government announced an additional £20 billion of spending, the OBR’s official forecast would assume that only £16 billion of this would actually get spent.

This relates to a broader point. It is not just the quantum of funding that matters: it is also important that it is spent well. An assessment of the merits (or otherwise) of Labour’s plans to ‘make Britain a clean energy superpower’ is beyond the scope of this piece. But it is clear that the specifics of things such as how Labour would redesign the Contracts for Difference scheme, or how its £2 billion Battery Power Fund would work, or how the new publicly owned energy company functions, will determine whether or not these are billions well spent.

There are further considerations. What wider economic impacts might this additional investment have, including on the supply side of the economy? At a time of weak growth, rising interest rates and elevated levels of debt, would this additional investment be consistent with Labour’s stated intention to have debt falling as a share of national income? In the run-up to the general election, as the economic and fiscal context becomes clearer, future IFS work will examine these and other questions.