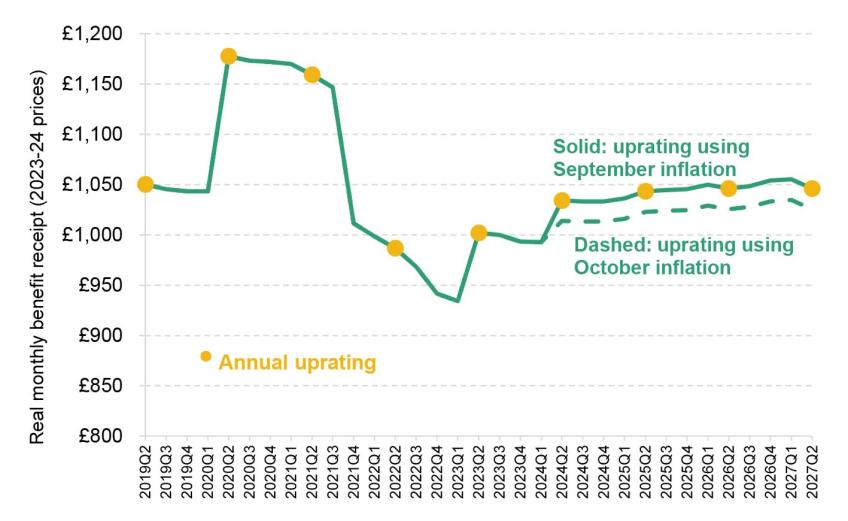

Normally, benefit values are uprated each April with the inflation rate of the previous September. It has been reported that, for the April 2024 uprating, the government is considering using the October rather than September inflation rate. This implies uprating by 4.6% rather than 6.7%.

• Because benefits are uprated using a lagged measure of inflation, real benefit values decline for a time when inflation rises, and rise during periods when inflation falls. As a result, real benefits levels have so far fallen as a result of the spike in inflation during the cost of living crisis. By default, they would eventually regain their previous value, due to the reverse effect as inflation falls – though remarkably they are not set to return to their pre-pandemic value until 2026, even without this potential change in uprating month.

• Using the October rather than September inflation rate would cut working-age benefits spending by about £3 billion in 2024–25, largely by reducing entitlements for the 8 million working-age households receiving means-tested or disability benefits.

• Whether or not the switch to October uprating were made permanent or a one-off, making this switch at this time would represent a permanent cut to the size of the benefits system. Essentially this is because the inflation that occurred between September 2022 and October 2022 would never factor in to the uprating of benefits in any year.

Sam Ray-Chaudhuri, a Research Economist at IFS, said:

'Using the October rather than September inflation rate to uprate benefits would save the government money, by cutting incomes for millions of low-income working-age people. Importantly, both effects would be permanent, whether or not the move to basing annual benefit increases on the October inflation rate were to be retained in subsequent years. This implies that real benefit levels would not just take several years to regain their pre-pandemic values, due to the rather arcane lagged method for increasing them – they would never get back to where they were, without subsequent changes in policy.'

Figure 1. Average real benefit entitlement, excluding housing element, for out-of-work claimants of working age

Note: The large increase in benefit values between 2020Q1 and 2020Q2 and the fall between 2021Q3 and 2021Q4 are due to the introduction and expiry of the £20 per week uplift to universal credit.

Source: Authors’ calculations using TAXBEN, based on Family Resources Survey 2019–20, and inflation from ONS (up to 2023Q3), BoE November 2023 Monetary Policy Report (2023Q4 to 2026Q4) and OBR Economic and Fiscal Outlook (2027Q1 onwards).