Following the high-profile campaign led by this newspaper, there has been speculation that the Government is considering scrapping inheritance tax.

Polling has consistently found that, along with council tax and stamp duty, inheritance tax is particularly unpopular. This is despite the fact that most married couples and civil partners won’t be liable unless their wealth is over £1m.

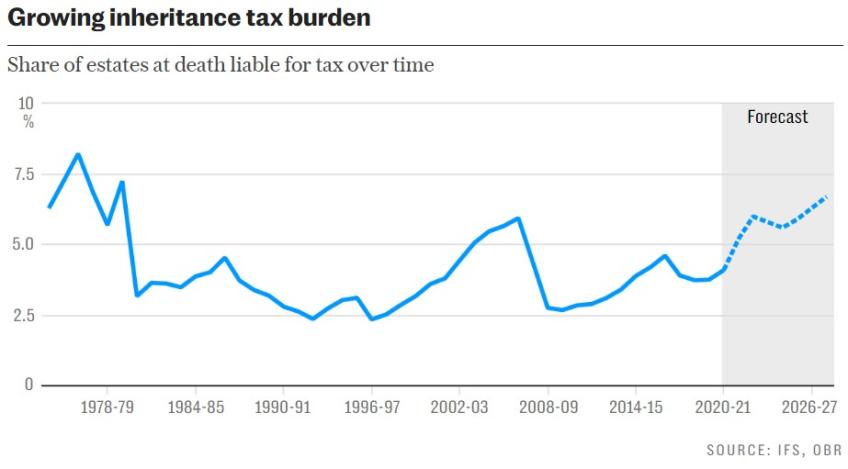

As a result, as the Treasury likes to point out, fewer than 7pc of deaths over the next few years are expected to lead to an inheritance tax bill.

But this misses the point.

Many more have reason to worry about a potential inheritance tax bill. As my colleagues at the Institute for Fiscal Studies have shown in a new report last week, inherited wealth has been growing – and over coming years will keep growing – more quickly than earned incomes.

As a result, in just ten years, 13pc of people will have an inheritance tax due either on their death or that of their partner.

Rising inheritances have several consequences. First, it means that the eventual cost of scrapping inheritance tax altogether will rise from £7bn this year to more than double that in just a decade.

That’s more than official forecasts suggest. Second, receipt of inheritance will become a growing determinant of an individual’s lifetime resources.

Put simply, an economy that has bigger inheritances relative to average earnings is one where it will be harder for those not fortunate enough to have wealthy parents to earn and save their way up the wealth distribution.

Third, bigger inheritances make it even more crucial that, if we are to have an inheritance tax, then it should be one that is well-designed. Failure to reform will mean inheritance tax causing increasing harm – both in terms of economic inefficiencies and straightforward unfairness.

The Treasury has asked for ideas for what the Chancellor should include in his forthcoming Autumn Statement. It is clear that inheritance tax needs to be simplified. Currently, every individual gets a £325,000 standard allowance and a separate £175,000 main residence allowance.

Because at death transfers to a spouse are exempt, and unused allowances can also be transferred, this means most couples can leave up to £1m tax free. But not all couples. An improvement would be to abolish the main residence allowance and increase the standard allowance to £500,000.

Those in London and the South East would see little benefit as inheritance tax payers there tend to benefit from the full value of the main residence allowance. But it would benefit significant numbers elsewhere – for example, in Wales only just over half of individuals with more than £500,000 in wealth have housing wealth worth more than £175,000.

This would come with a price tag of £700m a year, but would genuinely mean that, at least among married couples, only millionaires need worry about inheritance tax.

The Chancellor should not stop there. Another reason for the unpopularity of inheritance tax could be the extent to which the well-advised wealthiest avoid it.

Special carve outs exist for agricultural land, privately owned businesses, certain classes of shares, and funds that remain in a pension at death.

All are badly targeted. Astonishingly together they enable the wealthiest to achieve a situation where the average rate of inheritance tax paid by estates worth more than £7.5m is lower than that paid by estates worth between £2m and £5m. It is a tax that hits the wealthy harder than the extremely wealthy.

By restricting these reliefs the burden of inheritance tax on others could be reduced. To give one specific example: placing a cap on business assets relief at £500,000, and allowing any unused allowance to be transferred between spouses, would raise up to £1.1bn a year.

That would be sufficient to cut the rate of inheritance tax from 40pc to 35pc. And it would still allow couples with substantial business assets to bequeath £2m to their heirs without incurring any inheritance tax.

If the inheritance tax system is left as it is, revenues will grow strongly over the next few years. The risk is that this will mean a poorly designed tax doing even more damage than it currently does.

But this needn’t be the case: we could improve the tax, make it fairer, simpler and more efficient, and still raise at least as much as it does today. We should take that opportunity.

This article was first published in The Telegraph and is reproduced here with kind permission.