On Thursday, the Monetary Policy Committee (MPC) of the Bank of England will decide whether to increase the base rate once again after 12 consecutive rate rises from 0.1% in December 2021 to 4.5% last month. With last month’s publication of inflation rates showing a slower decline than had been expected, and last Tuesday’s earnings figures showing continued strength, many banks have increased mortgage rates again in recent weeks, in anticipation of the MPC raising the base rate further. The average two-year fixed mortgage now stands at 6.01%, having been just 2.65% in March 2022.1

Overall, over 14 million adults aged 20 and over, or over around a third of them, have a mortgage (including just over half of 30 to 50-year olds).2 Many have fixed rate mortgages and so in the short run are shielded from rate rises. But eventually those fixed terms will come to an end and they will be exposed to much higher rates, implying bigger monthly repayments. Around a quarter of mortgages are set to come off a fixed term deal between 2022Q4 and 2023Q4.3

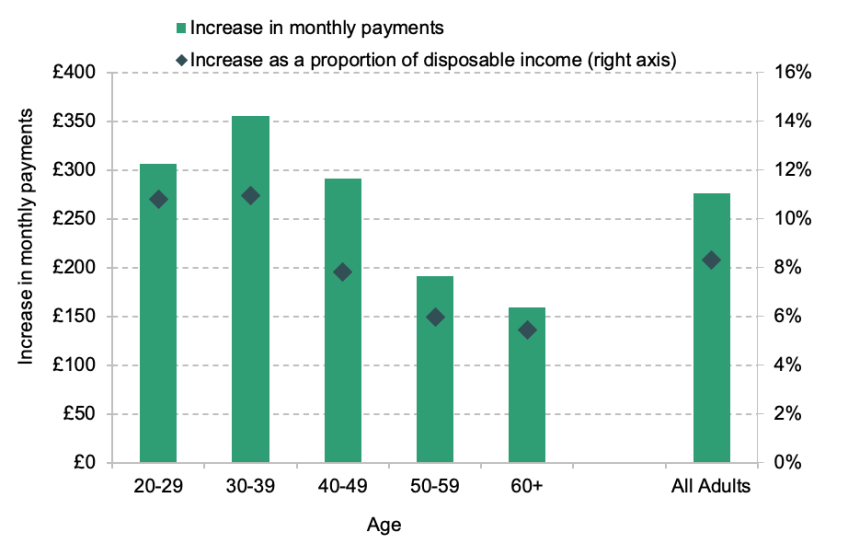

In March 2022, households with a mortgage were spending an average of £670 per month on mortgage payments, £230 of which was on interest payments. Figure 1 shows how those figures will change if mortgage interest rates remain at their current level, relative to a situation where the March 2022 interest rates persisted. On average those in mortgage-holding households will pay almost £280 more each month, with 30-39-year olds paying almost £360 more. This will be a significant hit to mortgagors’ disposable incomes (i.e. incomes after mortgage payments) at a time that families are already under strain – on average disposable incomes will fall by 8.3%, with those aged 30-39 again seeing the biggest hit (almost 11%). For some the rise will be substantially larger: almost 1.4 million – 690,000 of whom are under 40 – will see their disposable incomes fall by over 20%.

Figure 1. Average increase in mortgage payments amongst adults in mortgage-holding households, by age

Note: Impact of an increase in mortgage rates of 3.74 percentage points, compared to March 2022. Sample is comprised only of heads of households and their spouses.

Source: Authors’ calculations using Family Resources Survey, 2019–20.

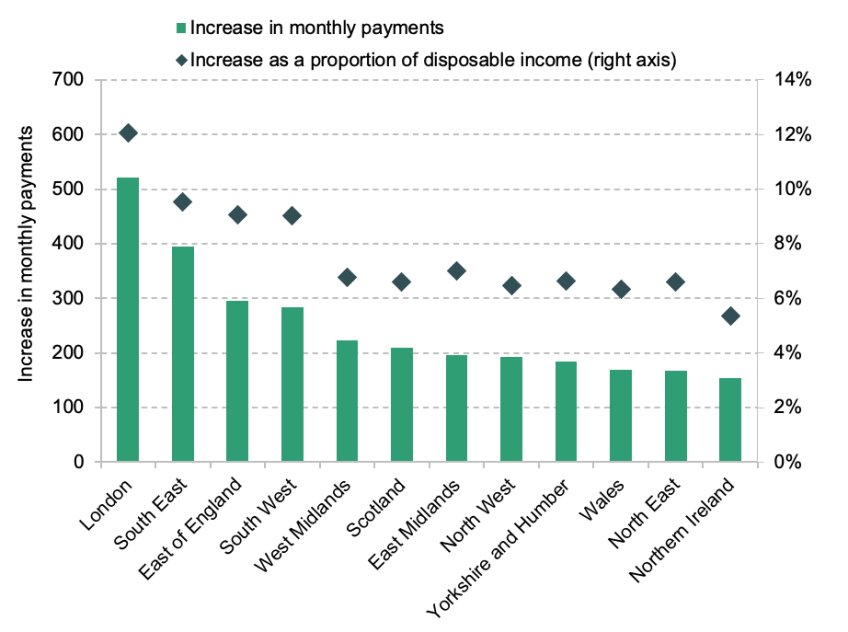

As well as differences by age, there are also differences between the regions, with average rises amongst mortgagors ranging from just over £150 in Northern Ireland to £390 per month in the South East and £520 in London. Falls in disposable income will be roughly 6-7% in much of the North of England, Midlands, Scotland and Wales, but will reach 9.4% in the South East of England and 12% in London.

Figure 2. Average increase in mortgage payments amongst adults in mortgage-holding households, by region

Note: Impact of an increase in mortgage rates of 3.74 percentage points, compared to March 2022. Sample is comprised only of heads of households and their spouses.

Source: Authors’ calculations using Family Resources Survey, 2019–20.

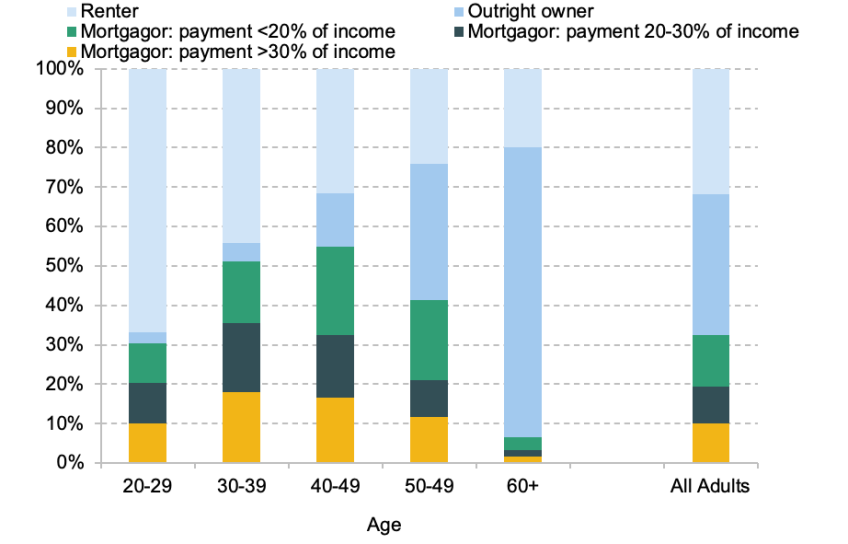

The upshot of this is that more households will be spending high proportions of their incomes on mortgage costs. Figure 3 splits all individuals – including those without a mortgage (i.e. those who rent or own outright) – according to how much of their family income will go on mortgage payments, if interest rates remain at their current level.

Overall, 60% of those with a mortgage (8.5 million; 19% of adults) are set to spend more than a fifth of their incomes on mortgage payments. This is a substantial increase. In March 2022, only 36% of mortgagors were in this position (5.1 million; 12% of adults). It also higher than in 2007-08, before mortgage rates started to fall rapidly following the Great Recession. Back then, just over half of mortgage holders were spending more than a fifth of their income on mortgage payments.

Figure 3. Proportion of family income spent on mortgage payments, by age; including non-mortgagors

Note: Impact of an increase in mortgage rates of 3.74 percentage points, compared to March 2022. Sample is comprised only of heads of households and their spouses.

Source: Authors’ calculations using Family Resources Survey, 2019–20.

Increased housing costs for mortgagors are yet another pressure on household finances, and it is not just owner-occupiers who are under pressure. Renters have also seen very large increases in their rents over recent months, and historically this group have had higher housing costs than mortgagors – with renters paying 24% more than mortgagors on average pre-pandemic. It is likely that at least part of the increases in rents we are seeing is due to high interest rates hitting landlords’ borrowing costs.

Given that inflation has risen to levels not seen in decades, rising interest rates are essentially inevitable. But it is unquestionably going to cause serious difficulty for many families. Notably, the UK benefit system provides relatively little support for low income mortgagors compared to what’s on offer for low income renters, meaning that there is not much of a safety net for those who are particularly likely to struggle with rate rises.