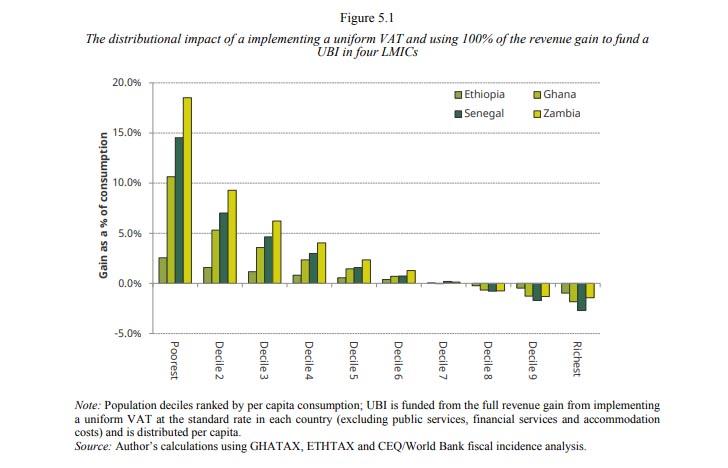

As in high-income countries, reduced rates of VAT and VAT exemptions (“preferential VAT rates”) are a common feature of indirect tax systems in LMICs. Many of the goods and services that are granted preferential rates – such as foodstuffs and kerosene – seem likely to receive such treatment on the grounds that they provide a means for the government to indirectly target poorer households, for whom such expenditures may take up a large proportion of their total budget. We use microsimulation methods to estimate the impact of preferential VAT rates in four LMIC countries, considering their effect on revenues, poverty, inequality, and across the consumption distribution. We consider whether other policy tools might be better suited for the pursuit of distributional objectives by estimating the impact of existing cash transfer schemes and a hypothetical scenario where the revenue raised from broadening the VAT base is used to fund a Universal Basic Income (UBI) in each country. We find that although preferential VAT rates reduce poverty, they are not well targeted towards poor households overall. Existing cash transfer schemes are better targeted but would not provide a suitable means of compensation for a broader VAT base given issues related to coverage and targeting mechanisms. Despite being completely untargeted, a UBI funded by the revenue gains from a broader VAT base would create large net gains for poor households and reduce inequality and most measures of extreme poverty in each of the countries studied – even if only 75% of the additional VAT revenue was disbursed as UBI payments.

This is the first draft of a paper examining the distributional impacts of VAT exemptions and reduced rates and direct cash (and near-cash) transfer schemes in a series of low and middle income (LMIC) countries. All results presented are preliminary; it is being shared in order to elicit comments and provide early sight of findings we consider robust.

Figure 5.1 from the working paper - The distributional impact of a implementing a uniform VAT and using 100% of the revenue gain to fund a UBI in four LMICs