The IFS Green Budget 2000, produced in collaboration with Goldman Sachs, is published today, Wednesday 26th January.

Economic prospects

The fears of recession that held sway at the time of last year's Green Budget have now given way to concerns that growth in the UK economy may be too strong to be consistent with the government's inflation target. Prospects are good for continued above-trend GDP growth in coming quarters. For 2000 we forecast GDP growth of 2.9%, but the economy will need to slow towards the trend rate during 2000 if the inflation target is not to be overshot in 2001. To achieve this, official interest rates may still need to rise a little further.

An audit of the public finances

We expect Public Sector Net Borrowing to be -£6.8bn (i.e. a surplus) in 1999-00, £3.3 billion better than the November 1999 Pre-Budget Report forecast. The improvement is due to lower levels of total spending, as unemployment has continued to fall and there has been no need to call on the £3.5 billion reserve. The government's fiscal rules will easily be met in 1999-00, and we expect a further improvement in 2000-01. On unchanged policies our medium term borrowing forecasts are, on average, £7-8 billion a year lower than the Treasury's Pre-Budget Report forecasts. The Chancellor needs to aim for current budget surpluses if he is to be sure that his fiscal rules will continue to be met. Even so, the forecast surpluses in our central projection are large enough to allow some increases in public spending or reduction in taxation.

The Chancellor must balance three concerns.

- First, that fiscal policy should support monetary policy.

- Second, he might want to prevent the tax burden from rising, which would require tax cuts in the Budget of around ó billion.

- Third, he will not want to restrict his room for manoeuvre in the forthcoming Comprehensive Spending Review.

Public spending

As a result of the relatively low real increases in spending over the first two years of this parliament, public spending is likely to fall slightly as a share of GDP between 1996-97 and 2001-02. Over the whole parliament the real rate of growth in current spending, on present plans, will be lower than that seen under the last Conservative government, while capital spending will grow more quickly. NHS spending in this parliament will grow at the same real rate as achieved on average since 1953-54, but it is growing rather faster in the three years from April 1999, as shown in Table 1. If the second CSR were to deliver real growth in spending on the NHS averaging 5% per year, the period from 1999 would see an unusually sustained growth in health spending. This would still be likely to leave the UK some way below average EU health spending.

Direct taxes on individuals

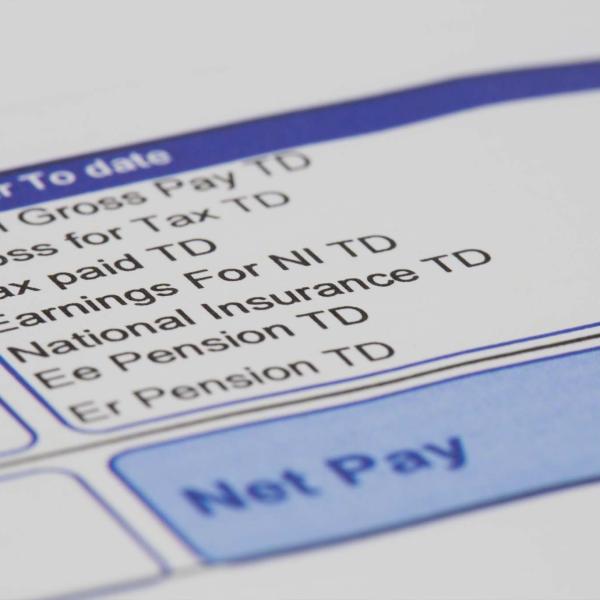

The government has already announced substantial and welcome changes to the structure of national insurance contributions (NICs) for employees and employers, taking further the trend towards integration with income tax. The gap between the upper earnings limit for employee NICs, and the starting point for higher rate income tax is falling substantially, as shown in Table 2. Closing this gap completely would raise under £600 million. Those individuals losing from this change could be compensated by using this revenue to reduce the rate of employee NICs.

Taxes on business and enterprise

The Budget is likely to contain a range of measures intended to benefit smaller companies, including substantial tax reliefs for share options awarded to selected employees in small firms, reductions in capital gains tax on business assets, and a new R&D tax credit restricted to smaller firms. Tax-reliefs limited to the small firms' sector are unlikely to have a large impact on total levels of investment and R&D spending. The proposed new all-employee share ownership plan is the latest in a long line of tax-favoured schemes intended to encourage employees to hold shares in the firm that they work for. While greater employee involvement may be a good thing, the rationale for using the tax system to favour this arrangement has never been entirely clear.

Other issues

The Green Budget also considers excise duties, reforms to in-work benefits and the New Deal, Individual Savings Accounts, the taxation of charitable giving, the future of the 10p tax band and the impact of taxation on company location and mobile activities such as gambling.

Table 1. Real increases in NHS spending in the United Kingdom: selected periods. Annualised average real increase (per cent)

CSR Period: April 1999 to March 2001 | 4.7 |

This parliament: April 1997 to March 2001 | 3.7 |

Last parliament: April 1992 to March 1997 | 2.6 |

Conservative years: April 1979 to March 1997 | 3.1 |

Highest 3 year period of growth since 1979-80: 1989-90 to 1992-93 | 5.4 |

Last 45 years: 1953-54 to 1998-99 | 3.7 |

History of NHS: 1949-50 to 1998-99 | 3.4 |

Table 2. Higher rate tax threshold and National Insurance upper earnings limit (1999 prices).

Higher tax | Upper earnings | Difference between | |

1980-81 | £32,431 | £22,040 | £10,391 |

1985-86 | £32,555 | £24,374 | £8,181 |

1990-91 | £32,052 | £24,608 | £7,443 |

1995-96 | £30,965 | £25,462 | £5,503 |

1999-00 | £32,335 | £26,000 | £6,335 |

2000-01 | £32,335 | £27,820 | £4,515 |

2001-02 | £32,335 | £29,900 | £2,435 |

| Ends |

Notes to editors

- The IFS Green Budget: January 2000, edited by Lucy Chennells, Andrew Dilnot and Carl Emmerson is published on 26th January 2000 and is available from the IFS, 7 Ridgmount Street, London, WC1E 7AE, telephone 020 7291 4800 or e-mail @email

- The Green Budget is also available from the IFS website after the conference.