Book Chapter

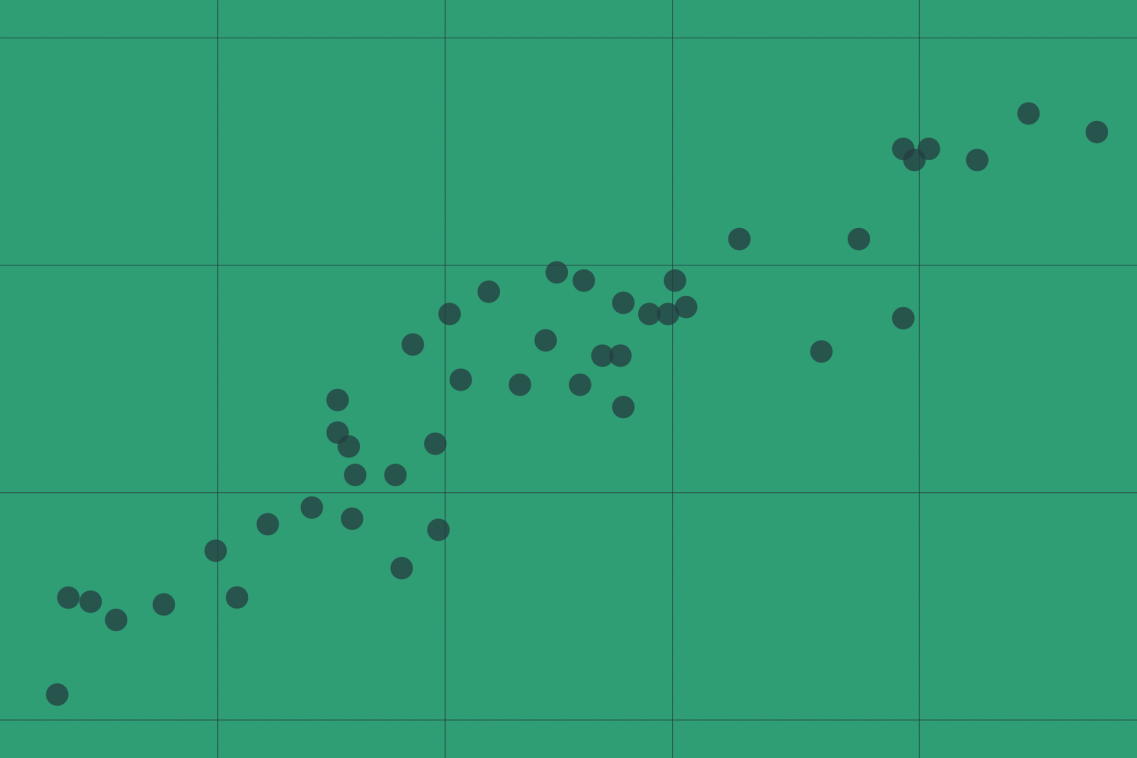

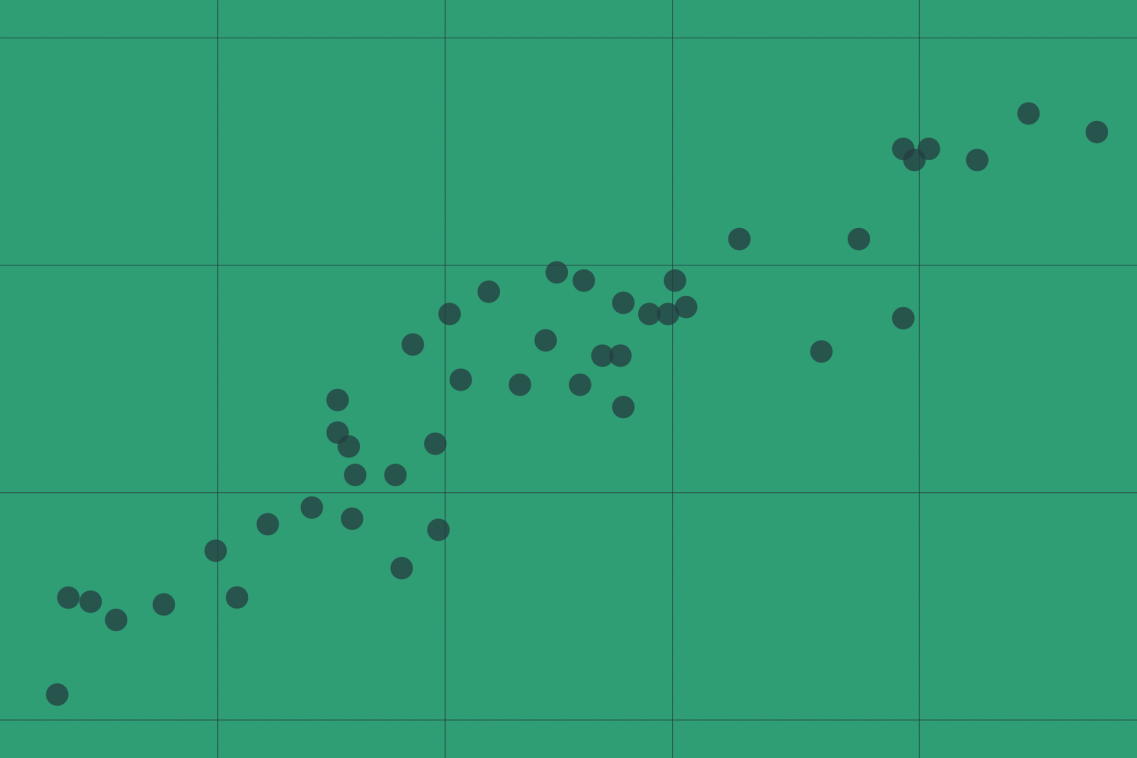

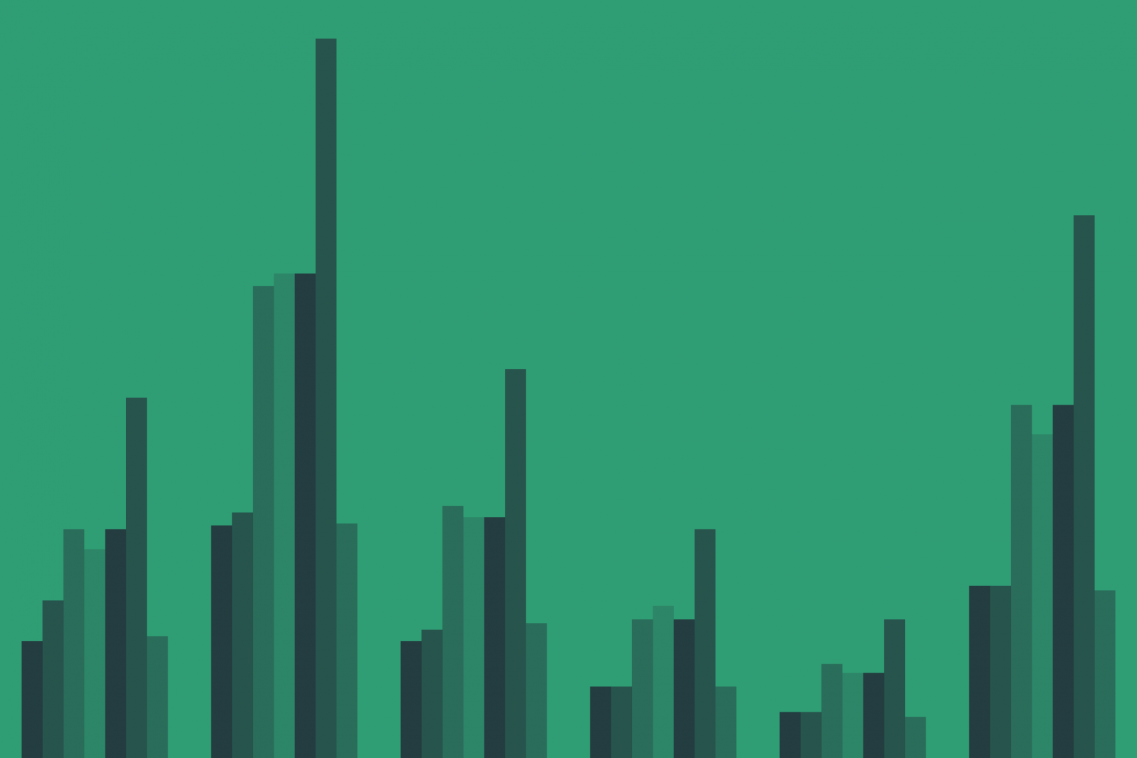

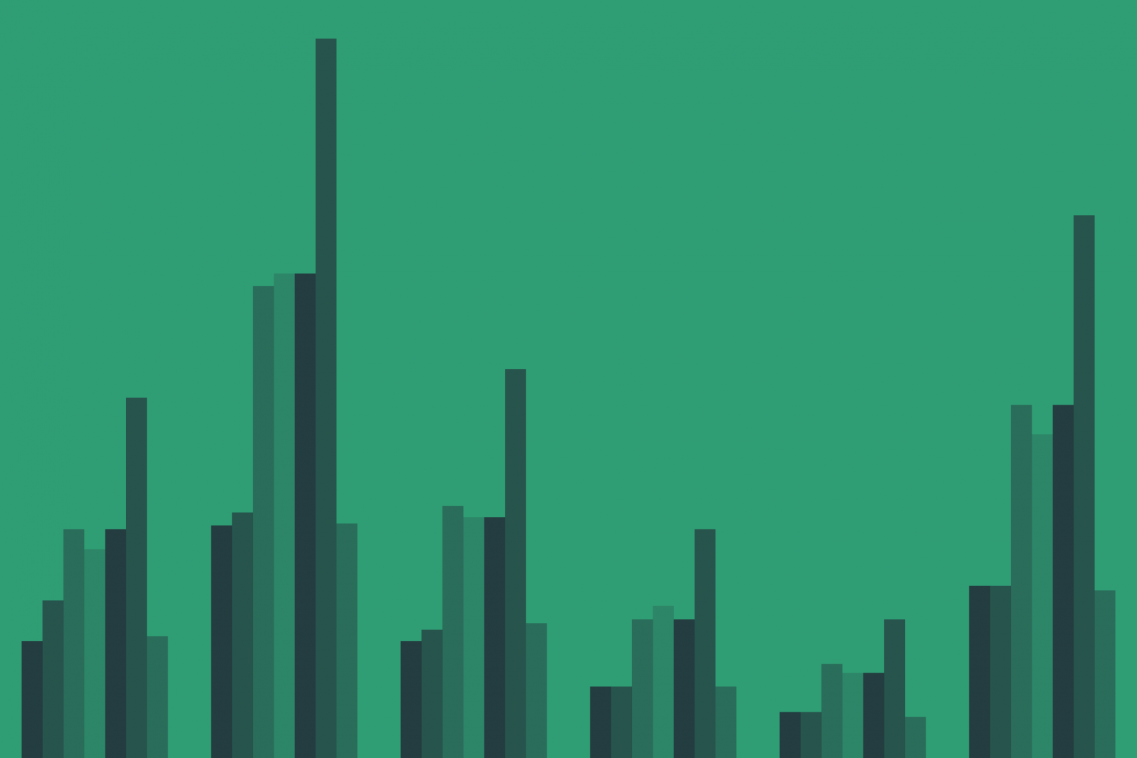

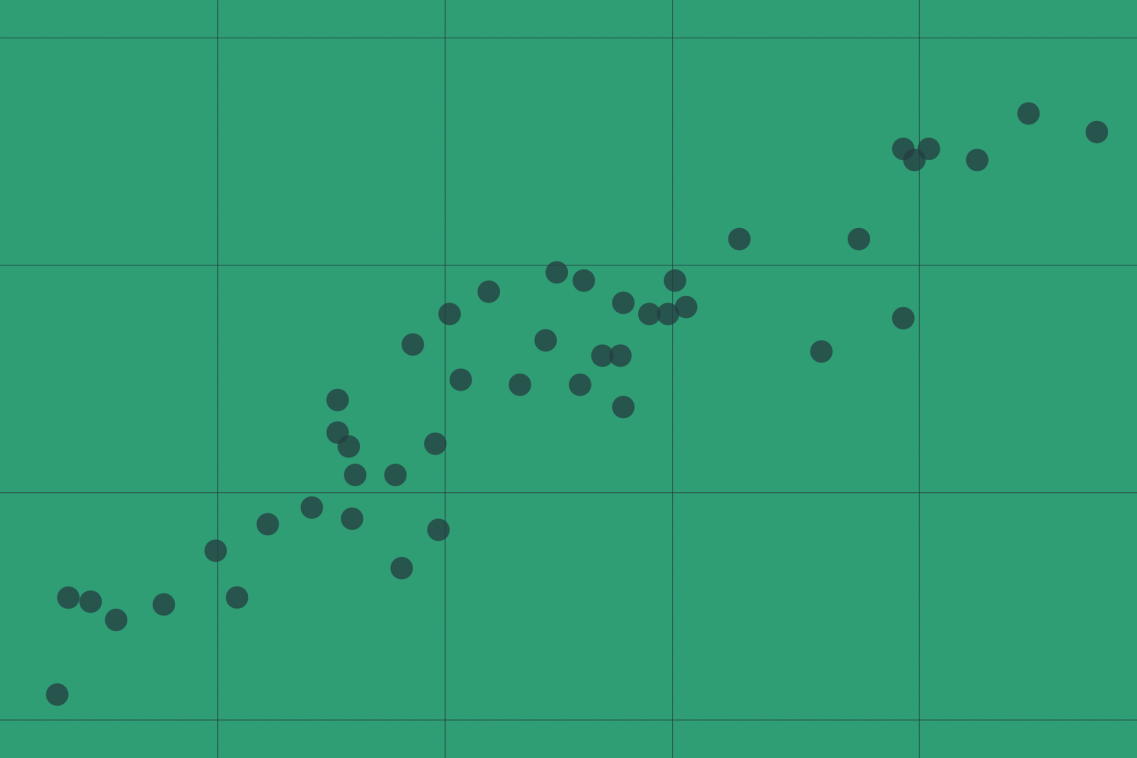

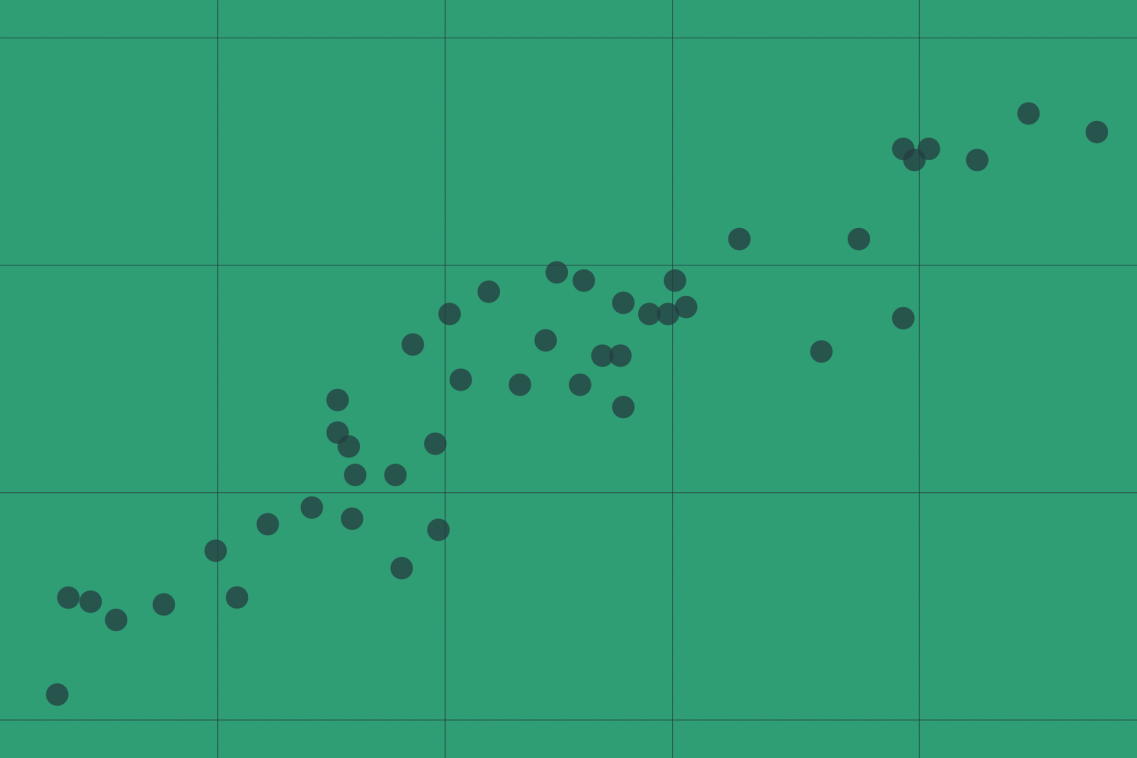

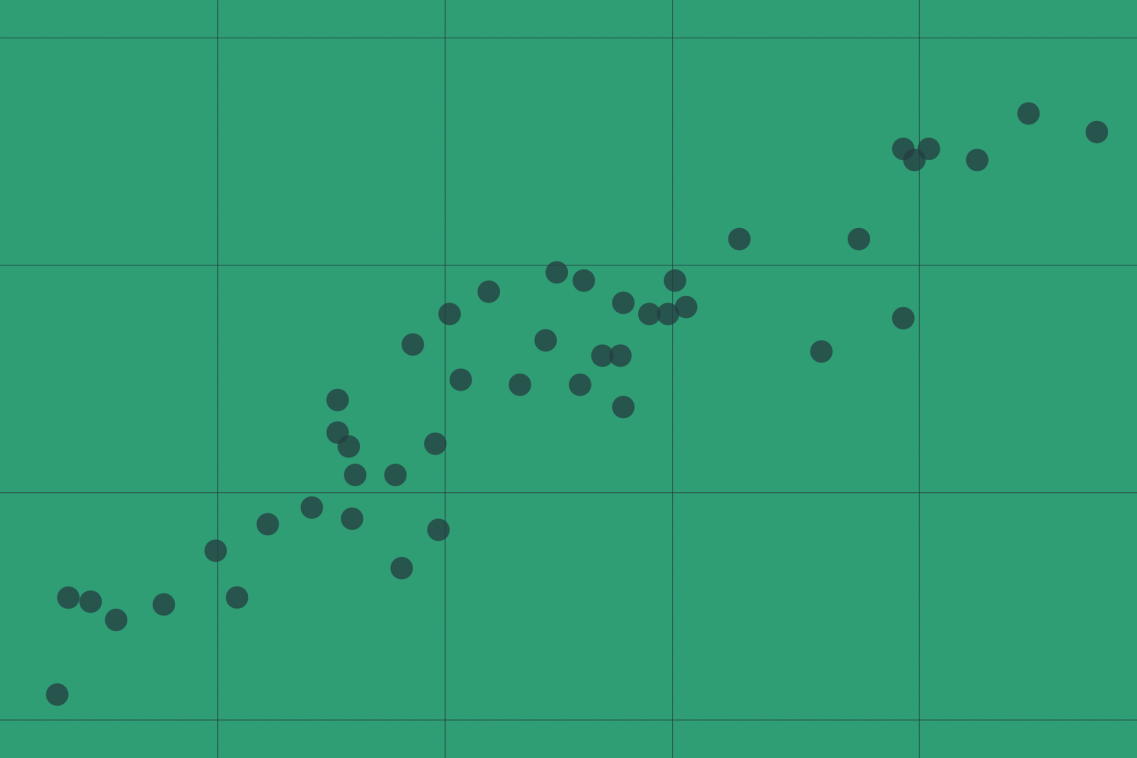

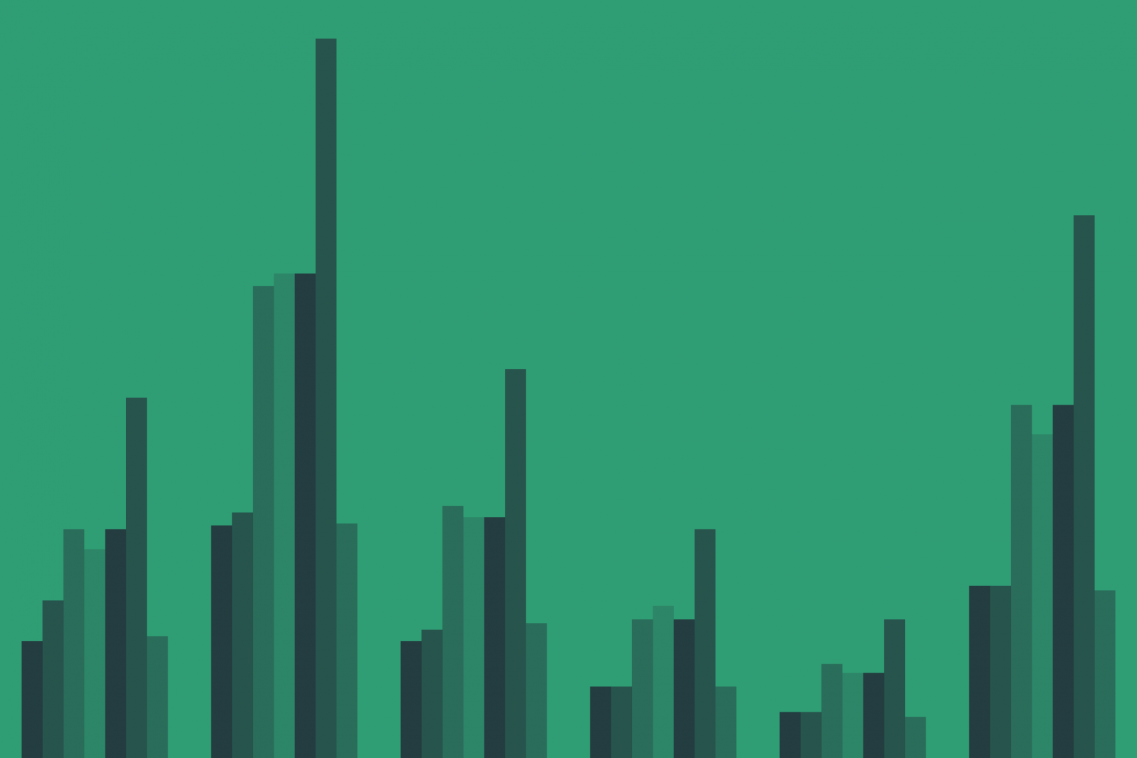

Post-financial-crisis, public sector borrowing – the gap between government revenue and spending – has fallen and, at the March 2019 Spring Statement, it stood below its long-run historical average. However, a number of changes have occurred since March, or loom on the horizon.