Last updated: 29 September 2015

What are DEL and AME?

For planning purposes, total public spending or total managed expenditure (TME) is divided into two components:

- Departmental expenditure limits (DELs) cover spending that the government argues can be controlled rather than being driven by demand. For example, most spending on the NHS, transport and education falls into this category. DELs are supposedly 'firm limits' for departments' spending, set several years in advance for each government department in Spending Reviews. In reality, the government can and does subsequently revise departments' budgets.

- Annually managed expenditure (AME) is allocated annually. Its largest components are social security payments, debt interest, and spending by local authorities. Spending on these areas is more difficult for the Treasury to plan in advance – for example, local authorities' spending depends on how much they raise from council tax revenues, while debt interest spending depends on how much the government borrows and what interest rates turn out to be. The government arguably can control social security spending by changing the qualification criteria or generosity of particular benefits, but it can be hard to do this at short notice. The Office for Budget Responsibility (OBR) publishes forecasts for future AME based on announced policies in each Budget and Autumn Statement. Since 2014, these forecasts have also been accompanied by a cap on the amount that can be spent in total on a large proportion of welfare benefits. For more information on the welfare cap, see this 2014 Green Budget chapter and this observation.

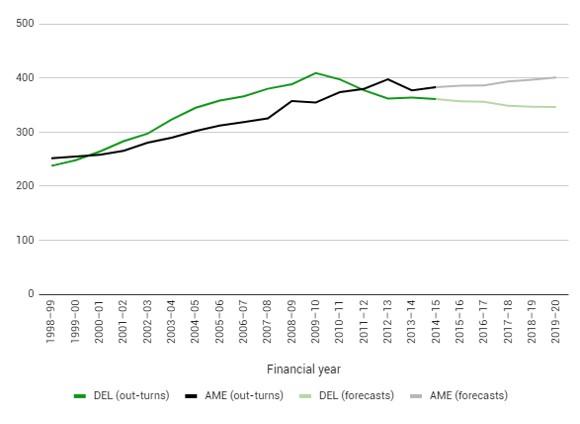

Broadly speaking, DEL and AME each accounts for around half of total spending. The exact composition has changed over time: between 1998–99 and 2007–08, DEL grew more rapidly than AME, and so represented an increasing proportion of total public spending. Since the financial crisis, DEL has been cut by more than AME (which has continued to increase in real terms), and so the proportion of total spending that is DEL has declined. Figure 1 shows the level of DEL and AME in real terms over time.

Figure 1. DEL and AME (£ billion, 2015–16 prices), 1998–99 to 2019–20

Note: DEL and AME are adjusted to offset the effects of council tax benefit localisation, the business rates retention policy and the reclassification of Network Rail.

Source: Authors' calculations based on various editions of HM Treasury's Public Expenditure Statistical Analyses (PESA).

Capital and resource spending

Both AME and DELs are divided into one budget for capital spending (i.e. for investment spending that adds to the public sector's fixed assets) and another budget for spending on other non-investment items, known as 'resource' spending. A department cannot transfer funds from its capital budget to its resource budget, although it can transfer money in the other direction. This separation of DELs into capital and resource components was designed to encourage departments to undertake the public investment they were budgeted to do.

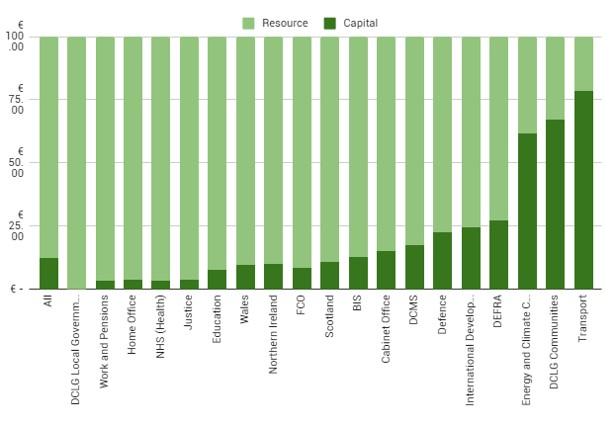

Figure 2 shows the composition of each department's total DEL for 2014–15. It illustrates the vast differences in capital intensity across departments. The most capital-intensive departments are the Communities budget of DCLG, the Department for Energy & Climate Change and the Department for Transport, with their capital DELs accounting for around three-fifths to three-quarters of their total DELs.

Figure 2. Proportion of each departmental budget allocated towards capital and resource spending in 2014–15 (%)

Note: Resource spending excludes depreciation. BIS is the Department for Business, Innovation and Skills; DCLG is the Department for Communities and Local Government; DCMS is the Department for Culture, Media and Sport; DEFRA is the Department for Environment, Food and Rural Affairs; FCO is the Foreign and Commonwealth Office. The 'Northern Ireland' category refers to the Northern Ireland Executive and does not include the Northern Ireland Office.

Source: HM Treasury, Public Expenditure Statistical Analyses (PESA).

he distinction in DELs between capital and non-capital spending was intended to protect capital spending from departments' tendency to underinvest. However, this separation did not stop capital spending being cut sharply between 2010–11 and 2012–13 (See this 2015 Green Budget chapter for more details.) This approach also has the potential disadvantage that if departments have a certain proportion of their budgets set aside for capital spending, irrespective of the benefits of that capital spending relative to the current spending that could be done in its place, then a situation could arise in which capital spending projects of low value to the public get commissioned while current spending ones of higher value do not.

Spending Reviews

Each government department's resource and capital DEL budgets are set several years in advance in a Spending Review. Table 1 lists all past UK Spending Reviews along with the dates for which departmental limits were set. Originally, there was a year of overlap between consecutive Spending Reviews – for example, the Spending Review of July 2002 revised plans already made for the 2003–04 tax year. This has not, however, been the case for the three most recent reviews. The next Spending Review will be published in November 2015.

Table 1. Past Spending Reviews

Date of Spending Review | Number of years covered | Dates for which departmental limits set |

3 | April 1999 – March 2002 | |

3 | April 2001 – March 2004 | |

3 | April 2003 – March 2006 | |

3 | April 2005 – March 2008 | |

3 | April 2008 – March 2011 | |

4 | April 2011 – March 2015 | |

1 | April 2015 – March 2016 |

Total departmental spending is typically set in advance of a Spending Review, usually in the preceding Budget; the Spending Review then allocates resources between individual government departments. In some cases, departmental budgets have been announced in advance of the Spending Review (for example, protection for the NHS and schools was announced in the run-up to the 2015 general election) and so the Spending Reviews allocate what is left.

When the Labour government originally introduced Spending Reviews, the budgets they set were intended to be 'firm and fixed'. However, in the past when the public finances turned out to be stronger than anticipated, departmental spending was often topped up. Conversely, since 2013, departments have often seen their budgets cut. For example, the 2013 Autumn Statement announced that 1.1% would be cut from most departments' resource DELs in 2015–16, despite these budgets having been set just six months earlier.

If departments spend more than they are initially allocated, they can in theory face penalties. However, if a particular project is turning out to be more expensive than planned for, departments can request extra funds from the 'reserve'. This is a cash amount set aside at each Budget for unanticipated overspends, which is allocated with approval from the Treasury.

Because of recent pressures to cut overall public spending, in the past few years departments have actually tended to underspend relative to their initial allocations set out in the Spending Reviews. An underspending department can use a process known as 'budget exchange' to transfer some resources to the following financial year. There are two conditions. The first is that the transferred resources must be below a certain cap (proportional to the size of the department) and the second is that the request for a transfer must be made before final spending plans are set out to parliament in the February 'supplementary estimates' (i.e. shortly before the end of the financial year). Beyond February, the department effectively 'loses' any unspent funds. This system is designed to allow departments flexibility in their plans, but not to allow them to carry forward unplanned underspends.

Useful resources

- This report from the Institute for Government discussing in more detail the process by which departments' budgets were decided in the 2010 and 2013 Spending Reviews