Last updated: 29 September 2015

Looming on the horizon are significant pressures on public spending, coming from a growing and ageing population. Projections from the Office for Budget Responsibility (OBR) suggest that as the population ages, spending on the state pension, health and social care will increase. For example, despite recent reforms to the state pension system, the OBR’s forecasts suggest that between 2019–20 and 2064–65 spending on state pensions will increase by 2.2% of national income.

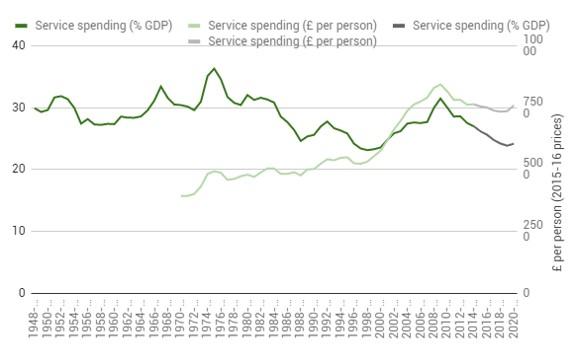

Figure 1 shows how spending on public services (defined as total public spending less spending on social security and debt interest) is forecast to evolve through to 2020–21 on the basis of the July 2015 Budget plans. The growing population intensifies the effects of the real-terms cuts to spending: while public service spending is forecast to be cut by 4.3% between 2010–11 and 2019–20, public service spending per person is forecast to be cut by 10.0%. Service spending per person will be reduced to around the level it was in 2004–05, while as a share of national income is it forecast to reach its lowest level since 2000–01. However, how long a future government is able to maintain what would be an almost historically low proportion of national income being spent publicly remains to be seen.

Figure 1. Spending on public services (% of GDP and £ per person (2015–16 prices)), 1948–49 to 2020–21

Note: Public service spending is total public spending less social security and debt interest spending.

Source: TME from ONS series KX5Q. Debt interest out-turns from ONS series JW2L and JW2P; debt interest forecasts from OBR, Economic and Fiscal Outlook: July 2015. Social security derived from DWP’s benefit and tax credit expenditure forecasts.

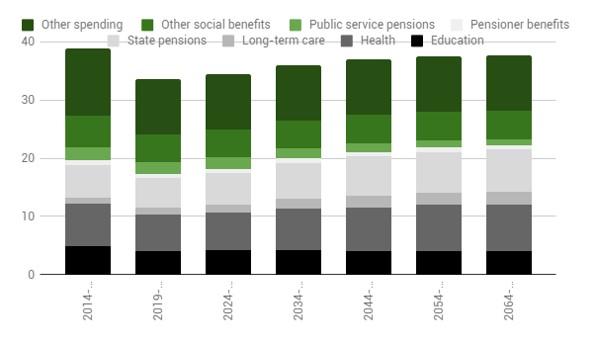

Public services will face financial pressure in the longer term from increasing demand due to the ageing population. The OBR projects that under ‘unchanged policy’, demographic change would require public spending (excluding spending on debt interest) to increase from 33.5% in 2019–20 to 37.7% by 2064–65. Figure 2 describes the OBR’s projections for spending on different areas. While most components of spending shown in Figure 2 are projected to remain fairly stable as a share of national income, spending on the state pension, health and long-term care are set to increase as the baby boomers retire and the population ages. By 2064–65, the effects of this ageing population will have offset most of the reductions in public spending from the fiscal consolidation planned between 2014–15 and 2019–20.

Figure 2. Long-run public spending projections (% of GDP)

Note: Other spending excludes interest and dividends. The state pension figures include the cost-saving effects of the single-tier pension, affecting those reaching the state pension age after April 2016, as well as the planned future increases in the state pension age.

Source: OBR, Fiscal Sustainability Report: June 2015.

The increase in state pension spending over the next few decades arises not only because of the growing number of pensioners but also because policy changes and changes in work patterns mean that future pensioners will have higher average state pension entitlements than their predecessors. The government has reformed the state pension to offset some of this increase; the Pensions Act 2014 reformed the state pension system to introduce a new ‘single-tier’ pension, which, in the long run and compared with unchanged policy, will be less generous to almost everyone other than the self-employed.1 However, even with the reform, state pension spending is forecast to increase from 5.5% of GDP in 2014–15 to 7.3% by 2064–65.

Health spending is also forecast to increase as a share of national income as the population ages. The increase in forecast health spending in the OBR’s central scenario is entirely driven by an ageing population. An even larger increase in health spending might be required if the health sector experiences lower productivity growth than other sectors of the economy, as it has in the past (perhaps due, for example, to the fact that health care is relatively labour intensive). The OBR presents an alternative forecast for health spending, projecting forward weaker productivity growth. This suggests health spending would need to increase by 5.0% of national income more by 2064–65 than shown in Figure 2. However, there are also reasons to think that health spending could be lower than this in the future – for example, if people at a given age are healthier in future than they are now and so use less health care.