Brexit has the potential to have a substantial impact on the prices households pay for food. Currently around 30% of the value of food purchased by households in the UK is imported, and the major source of food imports is the EU. In comparison, only 17% of overall consumer spending is on imported goods. This means that changes in the costs of imports – for example, through changes to tariffs or movements in exchange rates – are likely to have a particularly big impact on food prices. In new analysis released today, we study how different households might be affected by changes in the costs of food imports, due to tariff changes and exchange rate movements.

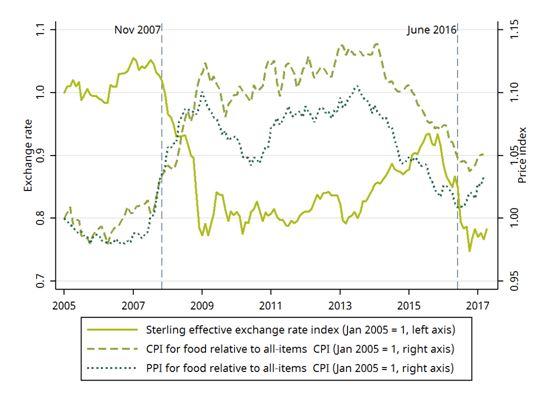

So far, the clearest and most immediate impact of the UK’s decision to leave the EU has been on the exchange rate. Sterling depreciated by 13% between January 2016 and March 2017; see Figure 1. This is an important determinant of the price of imports. Imports are purchased in foreign currency: when these currencies become more expensive relative to sterling (‘sterling depreciation’), more sterling is needed to purchase the same quantity of foreign currency, and therefore the same quantity of foreign goods.

One way to gauge the impact of sterling depreciation on food prices is to look at a previous episode.

From the beginning of 2007 to the end of 2008, there was a 21% depreciation in the effective sterling exchange rate; see Figure 1 again. Over the same period, prices overall rose by 6%, but food prices rose by 15% – that is, food prices rose by 9% relative to the prices of other goods and services. This period saw sharp increases in world commodity prices for key agricultural inputs, which are also likely to have contributed to increased food prices. However, while other countries (whose currencies did not depreciate) experienced food price rises, these were neither as large nor as persistent as the increase in the UK. This suggests that exchange rates played an important role in driving higher food prices in the UK.

So far, the depreciation in sterling since the beginning of 2016 has not been associated with similarly sized effects on food prices. The consumer price for food relative to the overall consumer price level initially declined after the referendum, but it started to increase moderately towards the end of 2016. The rise in producer prices since the referendum has been somewhat faster, however, and these costs are likely to be passed on to consumers in the future.

Figure 1. Exchange rate movements and the real price of food

Note: The Producer Price Index (PPI) for food gives output (‘factory gate’) prices for producers of food products selling to the UK market. This is the price received by UK manufacturers. It covers any margin they make on the goods they sell, as well as any costs such as labour, raw materials and energy, interest on loans, site or building maintenance, and rent. Both the PPI and CPI (food) are shown relative to the all-items Consumer Prices Index (CPI). The effective exchange rate and the price indices are rebased to equal 1 in January 2005.

Source: Bank of England and the Office for National Statistics.

How food prices will change following the UK’s actual departure from the EU remains highly uncertain. Currently, the UK benefits from tariff-free trade within the EU, and the UK and other EU members levy common tariffs on products imported into the EU from other countries. As is generally the case across the world, these tariffs are, on average, higher on agricultural products than on non-agricultural products and there is a lot of variation in tariffs both across and within broad food groups.

If the UK leaves the EU customs union, it would be free to adjust the tariffs it charges on agricultural goods. Under World Trade Organisation (WTO) rules, the UK would not be able to set tariffs that discriminate between trading partners, except as part of a free trade agreement or to give developing countries special access to its market. If the UK and the post-Brexit EU fail to strike a free trade deal, it is likely tariffs would be imposed on EU imports into the UK, as the UK would be unable to impose zero tariffs on imports from the EU without also extending tariff-free access to all other WTO members. This would raise the price of food imported from the EU, which is the major source of food imports into the UK, accounting for 70% of gross food imports. Therefore if the UK did not strike a free trade deal with the EU, food prices would be likely to rise significantly. This could potentially be ameliorated if the UK reduced tariffs across the board by a substantial margin and/or decided to accept cheaper food imports that do not meet current EU regulatory standards. There would also be costs associated with non-tariff barriers, such as customs checks.

The UK could reduce tariffs from their current level, and may choose to do so, especially for imports of foods that are not domestically produced – for example, oranges and olives. It would also be free to strike free trade deals with other countries. In addition, if the UK ceased to be a full member of the EU single market, it would be able to apply different regulatory standards to food imports, leading to the possibility of importing hitherto banned produce (such as chlorinated chicken). Such changes would serve to lower the price of foods imported from non-EU countries. That said, most advanced countries seek to protect their domestic farmers through a combination of price supports, subsidies and trade barriers. The extent to which the UK would choose to act differently in this regard is not clear at this stage.

Tariff changes and movements in the exchange rate directly affect the cost of getting imported food products onto supermarket shelves. This will naturally feed into the prices faced by consumers for imported goods. The extent to which tariff changes and exchange rate movements feed through to prices is uncertain and may vary across goods. The prices of domestically produced products are also likely to change, for two reasons. First, many domestically produced products use imported inputs, and changes to firms’ costs will tend to feed through to the prices they charge for their final products. Second, changes in the price of imported goods are likely to lead to changes in the price of similar domestically produced goods because of competitive effects: for example, if the prices of imported goods rise, then domestic producers who compete in the same markets might take advantage of the opportunity to increase their prices too.

How might these changes affect different households? The first thing to consider is that lower-income households allocate a higher proportion of their spending to food than higher-income households (23% of spending for the lowest-income tenth of households versus 10% for the highest-income tenth). Poor households are therefore more exposed to rises in the general level of food prices.

It might be the case that poorer households buy less imported food and hence would be less exposed to price rises driven by exchange rate or tariff changes. In our briefing note, we show that there are big differences in import penetration between food groups – for example, 39% of fruit products are imported, while only 20% of bread and cereal products are imported. Additionally, using detailed spending data, we observe that some households spend a lot more on imported products within broad food groups than others do. For example, on average, households buy around 35% of their beef, lamb and pork from abroad, but some households buy all of it from overseas and others purchase none from abroad.

However, we find that these differences do not translate into any clear differences by income – the poor buy a similar fraction of their food from abroad to the rich. This means that poorer households typically allocate a larger share of their total spending to imported food, and therefore are more exposed to changes in the price of imported food.

There is a great deal of uncertainty over what the nature of the UK’s post-Brexit trading arrangements will be. Decisions over post-Brexit membership of the single market and participation in the customs union will have profound effects on the price and import mix of the foods on UK supermarket shelves. It is also unclear whether sterling will depreciate further – or appreciate – as Brexit proceeds. These uncertainties over tariffs and the exchange rate mean that UK households are potentially going to be affected by considerable and unpredictable changes in food prices, with the poorest households much more exposed to this risk than the richest households.