This morning the Office for National Statistics announced that inflation, as measured by the CPI, was 1.0% in the year to September. This is somewhat higher than the 0.6% the Office for Budget Responsibility forecast in the March Budget. But since then many forecasters – including the Bank of England – have revised up their forecasts for future inflation as the sharp drop in the value of the pound since the referendum is expected to push up prices. This observation focuses on one consequence that higher inflation would have: the fact that it would reduce the real incomes of working age families receiving benefits that the Government has frozen in cash terms through to March 2020.

Since the UK referendum vote to leave the EU the value of the pound has declined sharply. From almost $1.50 on the eve of the result, the pound has fallen to around $1.20; against the euro, the pound has fallen from around €1.30 to €1.10. This sharp decline will increase the price of imported goods. Just after the Budget, in its April World Economic Outlook, the International Monetary Fund (IMF) forecast CPI inflation to rise to 1.9% in 2017 before settling at 2.0% from 2018. By its October forecast the IMF had revised its inflation expectations to 2.5% in 2017 followed by 2.6% in 2018. Those forecasts were based on the exchange rate as it stood in mid-September; since then the pound has fallen a further 7% against the dollar and so, if anything, these numbers may in fact underestimate future price rises.

Normally many of those on the lowest incomes would be at least partially protected from the impact of higher prices by the rules that govern the annual uprating of benefits and tax credits. By default, benefit and tax credit rates are (with some exceptions, most notably the state pension) increased each April in line with the annual CPI inflation rate of the previous September – higher prices lead to higher benefit rates (albeit with a lag). However, in the July 2015 Budget the Government announced that, as part of its attempt to cut annual social security spending by £12 billion, most working-age benefit and tax credit rates would be frozen in cash terms until March 2020. This policy represented a significant takeaway from a large number of working age households. But it also represented a shifting of risk from the Government to benefit recipients. Previously, higher inflation was a risk to the public finances, increasing cash spending on benefits. Now the risk is borne by low-income households: unless policy changes higher inflation will reduce their real incomes.

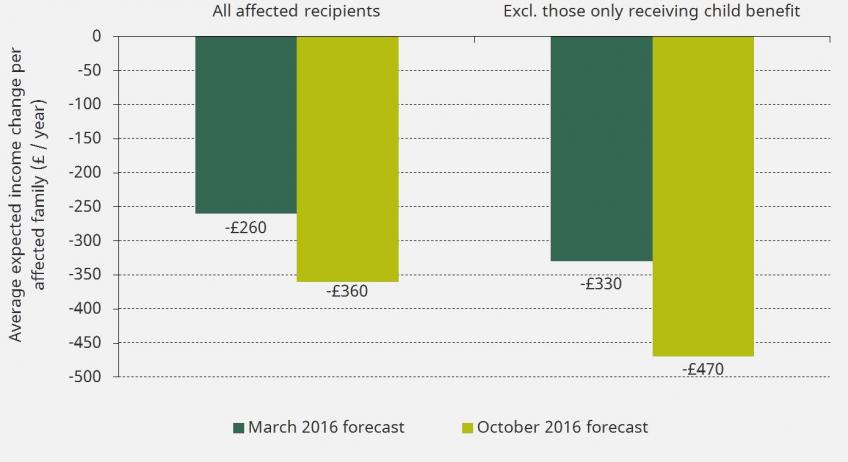

Figure 1 shows how the size of the expected cut in generosity resulting from the four-year cash freeze has increased in the light of upwards revisions to forecast inflation. As of March 2016 the freeze represented a 4% cut in the value of those benefits affected relative to previous plans (given OBR inflation forecasts). As a result, 11.5 million families were expected to lose an average of £260 a year, saving the government £3.0 billion in 2019–20. Given the latest inflation forecasts from the IMF, the policy now represents a 6% cut to affected benefits. The same 11.5 million families are now expected to lose an average of £360 a year (£100 a year more than expected in March), saving the government £4.2 billion in 2019–20 (i.e. an additional £1.2 billion over what was expected back in March). Greater losses are found among families – typically those on lower incomes – who receive more in benefits: for example, ignoring the 3.2 million families who only receive child benefit, the average loss from higher inflation rises to £140 per year (with the other 8.3 million families affected now expected to lose an average of £470 a year).

Figure 1: Average expected income change per family affected as a result of the benefit freeze, March and October 2016 based forecasts, 2016–17 prices

Source: Authors’ calculations using the IFS tax and benefit model, TAXBEN, run on the Family Resources Survey, 2013–14.

Setting benefit rates in cash terms rather than relative to prices is becoming something of a habit in the UK: prior to the four-year freeze from April 2015, the rates of many working age benefits were capped at 1% in cash terms in April 2013 and April 2014. There are at least two reasons why cutting benefit rates through limiting or eliminating cash-terms increases is a habit that should be kicked, regardless of the desired generosity of the system. First, from the government’s perspective, this way of cutting benefits means the size of the cut and the saving to government depends on (unknown) future inflation. In the last few years, lower-than-expected inflation has led to smaller cuts in the generosity of the system than the government intended – this was highlighted by the OBR in Chapter 3 of their latest Welfare Trends report, published last week. Second, from the benefit recipient’s perspective, there is a reason that benefits are uprated in line with prices by default – since one purpose of benefits is to provide a minimum standard of living, their level should reflect the cost of purchasing the goods and services required to provide that minimum standard. While it is perfectly reasonable to argue – as the 2015 Conservative Party manifesto did – that the working age benefit system should be made less generous over this parliament, it is hard to see why the appropriate size of cut should be arbitrarily determined by the impact of movements in sterling on prices.