Today, the Scottish Government published the latest version of its annual Government Expenditure and Revenues Scotland (GERS) publication covering 2012–13. The IFS will be publishing a full report on these figures and the last pre-referendum update of our assessment of Scotland’s fiscal position next month. But what are the key findings that jump out of the latest year of data?

For the first time in 5 years GERS suggests that Scotland's net fiscal balance, or budget deficit, was worse than that of the UK as a whole even when allocating North Sea revenues to Scotland on an illustrative geographic basis. Until now these revenues have been enough to more than outweigh the fact that public spending per head is significantly higher in Scotland than in the rest of the UK whilst non oil revenues have been much the same. But not in 2012–13.

Two things appear to have happened that explain a large part of this. First, total UK-wide North Sea revenues were substantially lower than in the recent past (£6.6 billion compared to £11.3 billion in 2011–12, for instance). Second, a smaller proportion of North Sea revenues have been allocated to Scotland in 2012–13 than 2011–12, although there have also been downward revisions to the estimated share in 2011–12’s compared to last year’s publication.

As we have said before it is important to think of oil revenues differently to other revenues because they are so volatile (and likely to run down in the longer term). These figures reaffirm the fact that an independent Scotland, like the rest of the UK, would have a substantial fiscal deficit. But higher spending in Scotland makes that deficit bigger than in the UK as a whole if oil revenues are not high enough to compensate.

The fiscal position

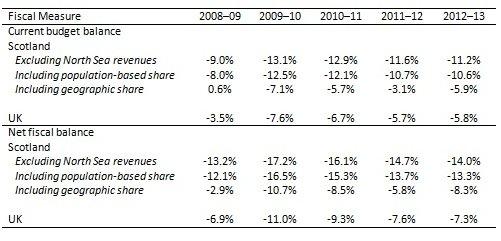

GERS includes two measures of the overall fiscal position. That is, the current budget balance, which is the difference between non-investment spending and revenues, and the net fiscal balance, which is the difference between total spending (including investment) and revenues. Figures are presented excluding North Sea revenues, as well as including population-based and illustrative geographic shares of North Sea revenues. Table 1 shows how each of these measures evolved between 2008-09 and 2012–13.

Table 1: Current and net fiscal balance (% of GDP), UK and Scotland, 2008–09 to 2012–13

Source: Government Expenditure and Revenues Scotland, 2012–13

Excluding North Sea revenues, Scotland’s public finances suffered a very substantial deficit in 2012–13: an 11.2% of GDP current budget deficit; and a 14.0% of GDP net fiscal deficit. However, this represents a slight improvement on 2011–12, when the deficits were 11.6% and 14.7% of GDP, respectively. This improvement in the onshore budget balance is a result of onshore revenues growing more quickly (by 2.7%) than government expenditure (0.5%). Indeed, the modest improvement in the onshore budget in 2012–13 was, if anything, slightly larger than that in the UK as a whole, although the level of the onshore deficits remains much higher in Scotland (for the UK as a whole, the onshore deficits are close to the overall deficits reported in Table 1).

The present Scottish Government has traditionally focused on fiscal measures including an illustrative geographic share of North Sea revenues. This seems reasonable: if Scotland were to become independent then it seems likely that apportionment of the North Sea would be on a geographic basis. Allocating a geographic share of North Sea revenues to Scotland improves its fiscal position substantially, although a large deficit remains: a 5.9% of GDP current budget deficit (versus 11.2% without North Sea revenues), and an 8.3% of GDP net fiscal deficit (versus 14.0%).

However, this represents a deterioration since 2011–12, when the current budget deficit including a geographic share of North Sea revenues was just 3.1% and the net fiscal deficit was 5.8% of GDP. This deteriorating fiscal position reflects an estimated fall in Scotland’s share of North Sea revenues from £10.0 billion in 2011–12 to £5.6 billion in 2012–13, following falls in oil and gas production and increases in production and investment costs (which are deductible from taxable profits). Previously, the Scottish Government had been forecasting North Sea revenues of between £6.7 billion and £7.2 billion in 2012–13.

These falls in North Sea revenues also mean that, whereas including a geographic share of North Sea revenues Scotland’s fiscal position was stronger than that of the UK in every year between 2008–09 and 2011–12 (and substantially better in 2008–09 and 2011–12), in 2012–13 the fiscal position was a little weaker in Scotland than in the UK as a whole. For instance, the net fiscal balance (including investment spending) is estimated to have been 8.3% of GDP in deficit, compared to 7.3% for the UK as a whole.

Of course, the decline in North Sea revenues was not helpful to the UK public finances either. But, because most North Sea revenues are estimated to come from the Scottish portion of the North Sea (84% in 2012–13), and because the Scottish economy and tax-base is much smaller than that of the UK as a whole, a fall in this revenue stream has a much larger proportional impact on Scotland. For instance, the fall in North Sea revenues in 2012–13 was equivalent to around 0.3% of GDP for the UK as a whole, but 3.1% of GDP for Scotland. The latest figures therefore illustrate how sensitive an independent Scotland’s public finances would be to volatility in North Sea revenues. As we have argued before, and the Scottish Government’s independent fiscal commission has recognised, this would require a Scottish government to design fiscal rules that reflect this sensitivity. And, if North Sea revenues continue to fall and remain at low levels, as forecast by the OBR, further fiscal tightening in addition to that planned by the UK government would be required to return Scotland’s public finances to health. Even if North Sea revenues do rebound in the medium-term, as the Scottish Government forecast in its independence White Paper, it might be wiser to bank that money to improve the public finances, and to prepare for the longer-term fiscal challenges of an ageing population and the eventual diminishing of North Sea revenues.

Comparing GERS 2012–13 with the IFS’s previous projections

These latest official figures follow publication, last week, of updated medium-term projections by the IFS. We anticipated that Scotland’s budgetary position would weaken in 2012–13. However, our projection for the net fiscal deficit of 6.8% of GDP was somewhat smaller than the outturn of 8.3% of GDP. What explains these differences?

First, part of the difference can be explained by the fact that the decline in North Sea revenues was accompanied by a decline in the total amount of economic output produced in the North Sea which led to a fall in Scottish GDP. A lower GDP means a given cash deficit represents a larger fraction of GDP. The GERS figures take account of this fall in GDP, but our projections did not (as the focus was on the outlook to 2016–17 and 2018–19 and official GDP forecasts are not available for Scotland).

There are also differences between our spending and tax projections for 2012–13 and the outturns reported in GERS.

Our projections for spending were around £0.3 billion lower and our projections for tax revenues around £1 billion higher than the actual outturns reported in GERS. Around half of the gap for taxes is due to Scotland’s North Sea revenues being lower than we projected. Our projections were based on 94% of UK North Sea revenues being allocated to Scotland on a geographic basis, which was the share reported for 2011–12 in last year’s GERS publication. Today’s publication instead allocates just 84% of North Sea revenues to Scotland (it also has revised the share for 2011–12 down to 88%). These revisions reflect the fact that it is difficult to divide up tax revenues between the different parts of the UK when they are collected on a national basis.

If these higher levels of spending, lower levels of taxes and GDP, and the resulting bigger fiscal deficit were to persist, Scotland’s medium-term fiscal position would be somewhat weaker than our projections last week suggested. This is likely to be unwelcome news. If the government of an independent Scotland wanted to make up this gap, the additional tightening of 1.5% of GDP (8.3% - 6.8%) that would be required equates to around £2.2 billion in today’s terms. This would come on top of the 2.9% of GDP tightening (£4.2 billion) we estimated would be required to match the fiscal tightening planned by the UK government for between 2016–17 and 2018–19. And, if the OBR’s forecasts for overall North Sea revenues turn out to be correct, even then, Scotland would have a net fiscal deficit of around 2.5% of GDP in 2018–19, compared to a forecast of budget balance for the UK as a whole in the same year.

Conclusions

How healthy an independent Scotland’s public finances would be is obviously a key issue for the forthcoming referendum: whether an independent Scotland would need further tax rises and spending cuts, or could ease the austerity, is one factor in whether independence would make Scottish families better or worse off. The GERS figures released today, because they are backwards rather than forwards looking do not provide the answer to this question. But they do remind us of three important things:

- That the health of an independent Scotland’s public finances would be affected by the strength of North-Sea revenues to a much greater extent than the UK as a whole;

- That these revenues can be extremely volatile from year-to-year;

- And that forecasting the public finances is a tricky business.

This means that in planning for independence, the Scottish Government should be cautious in its fiscal assessment, and avoid building its budget on the back of optimistic forecasts for North Sea revenues.