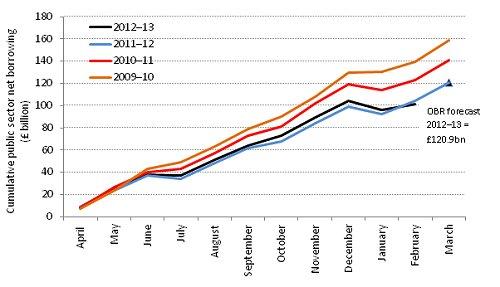

The March Budget forecast by the Office for Budget Responsibility (OBR) was for the headline deficit, excluding the impact of transfers related to the Royal Mail Pension Scheme and the Asset Purchase Facility, to be £120.9 billion in 2012–13, compared to £121.0 billion in 2011–12. This £0.1 billion projected fall in the deficit meant that the Chancellor’s Autumn Statement assertion that “[the deficit] is falling and it will continue to fall each and every year” remained on course to be met. This was achieved by Government departments’ pledging to underspend their budgets by a greater degree than normal, with some payments deliberately pushed from 2012–13 into 2013–14.

The evolution of borrowing through the last four financial years is shown in the Figure below. Between its peak in 2009–10 and 2011–12 overall borrowing is estimated to have fallen by almost a quarter in cash terms (from £158.9 billion to £120.9 billion). By contrast, for most of 2012–13 borrowing is estimated to have been running above the level seen last year. It was not until the first estimate of borrowing in February 2013 was released – the day after the Budget – that cumulative borrowing over the year to date was estimated to be lower than over the same period in 2011–12. Borrowing over the first eleven months of 2012–13 is currently estimated to have been 3% below the amount borrowed over the first eleven months of 2011–12.

Figure: Reducing the deficit?

Note: Public sector net borrowing excluding the transfer of assets of the Royal Mail Pension Scheme (£28 billion in April 2012) and the transfer of Asset Purchase Facility assets from the Bank of England to HM Treasury (£3.8 billion in January 2013 and £2.7 billion in February 2013).

On Tuesday, the Office for National Statistics is due to release its first estimate of public sector net borrowing in March 2013 and, therefore, for the whole of 2012–13. Whatever these data indicate – whether they suggest borrowing was slightly higher or slightly lower in 2012–13 than in the previous year – will not be the last word on the matter as revisions to past data are inevitable. We will not know for some time whether the deficit in 2012–13 was actually higher or lower than the deficit in 2011–12.

Whatever Tuesday’s figures suggest, it is important to bear in mind that there are no direct economic consequences either way. In economic terms it is irrelevant whether the deficit is slightly higher or slightly lower in 2012–13 than in 2011–12. Either way the bigger picture is the same: the Government has implemented a combination of tax rises, welfare spending cuts and cuts to spending on public services and brought about a reduction in the deficit between 2009–10 and 2011–12. However, while 2012–13 also saw further austerity measures being implemented, weak economic performance has meant that the deficit was largely unchanged from its 2011–12 level. The same is forecast to be true in the current financial year: the OBR's forecast is that borrowing will fall by just £0.9 billion to £120 billion in 2013–14. This would leave the deficit largely unchanged for three years.