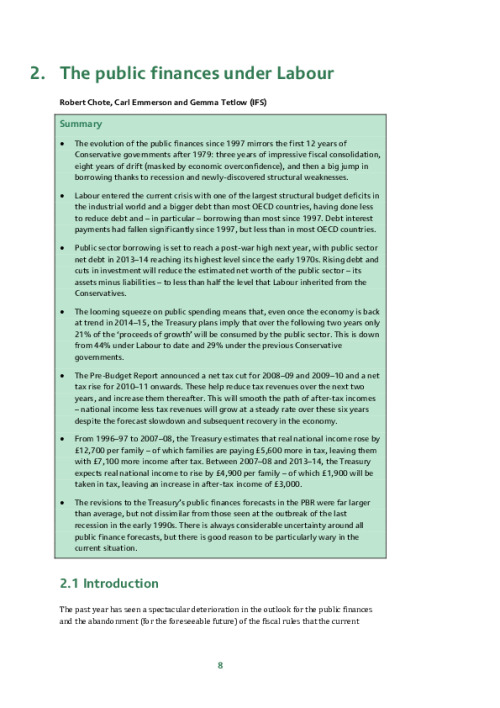

<p><p><ul><li>The evolution of the public finances since 1997 mirrors the first 12 years of Conservative governments after 1979: three years of impressive fiscal consolidation, eight years of drift (masked by economic overconfidence), and then a big jump in borrowing thanks to recession and newly-discovered structural weaknesses.</li><li>Labour entered the current crisis with one of the largest structural budget deficits in the industrial world and a bigger debt than most OECD countries, having done less to reduce debt and - in particular - borrowing than most since 1997. Debt interest payments had fallen significantly since 1997, but less than in most OECD countries.</li><li>Public sector borrowing is set to reach a post-war high next year, with public sector net debt in 2013-14 reaching its highest level since the early 1970s. Rising debt and cuts in investment will reduce the estimated net worth of the public sector - its assets minus liabilities - to less than half the level that Labour inherited from the Conservatives.</li><li>The looming squeeze on public spending means that, even once the economy is back at trend in 2014-15, the Treasury plans imply that over the following two years only 21% of the 'proceeds of growth' will be consumed by the public sector. This is down from 44% under Labour to date and 29% under the previous Conservative governments.</li><li>The Pre-Budget Report announced a net tax cut for 2008-09 and 2009-10 and a net tax rise for 2010-11 onwards. These help reduce tax revenues over the next two years, and increase them thereafter. This will smooth the path of after-tax incomes - national income less tax revenues will grow at a steady rate over these six years despite the forecast slowdown and subsequent recovery in the economy.</li><li>From 1996-97 to 2007-08, the Treasury estimates that real national income rose by £12,700 per family - of which families are paying £5,600 more in tax, leaving them with £7,100 more income after tax. Between 2007-08 and 2013-14, the Treasury expects real national income to rise by £4,900 per family - of which £1,900 will be taken in tax, leaving an increase in after-tax income of £3,000.</li><li>The revisions to the Treasury's public finances forecasts in the PBR were far larger than average, but not dissimilar from those seen at the outbreak of the last recession in the early 1990s. There is always considerable uncertainty around all public finance forecasts, but there is good reason to be particularly wary in the current situation.</li></ul></p></p>