In the immediate wake of the pandemic, the government announced a temporary increase in Universal Credit (UC) and Working Tax Credit entitlements by £20 per week (£1,040 p.a.), due to last for one year until March 2021 and benefiting around 6 million families per month. There have been various calls for this increase to either be extended or made permanent, and it is now being reported that the Chancellor is considering instead having a one off £500 ‘bonus’, equivalent in total to the £20 per-week uplift being paid for around 6 months. Extending the £20 uplift for a year would cost the Exchequer £6 billion, while a one off £500 bonus would cost something in the region of £3 billion. These costs would come on top of the roughly £100 billion spent on working-age welfare each year prior to the pandemic (equivalent to around 5% of GDP).

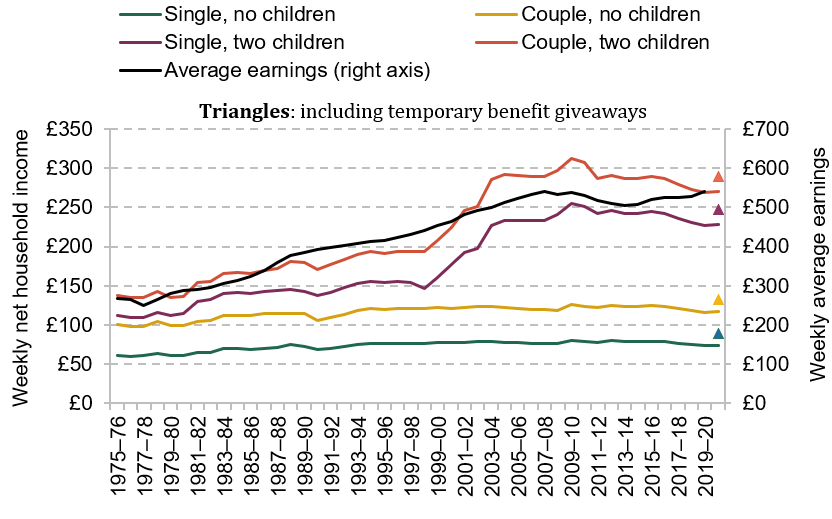

Figure 1 puts the temporary increase in the context of out-of-work benefit entitlements over the past 50 or so years. Families with children have roughly seen their incomes when out-of-work keep pace with growth in average earnings over that period, though they have somewhat fallen since 2010. For families without children, the £20 increase represents the first significant real increase in the last half century. As a fraction of earnings levels when in work, this means that the out-of-work (non-housing) safety net for childless families has been falling almost continually for 50 years, and the temporary uplift in 2020-21 – while sizeable – has barely made a dent in that decline.

Figure 1.Net household income over time for out-of-work families, by family type (July 2020 prices)

Source: Figure 8.3 from Bourquin and Waters (2020).

In an international context, the UK has a small out-of-work safety net relative to most other developed countries. This is partly because in the UK, out-of-work benefits are largely unrelated to how much a worker previously earned or ‘paid in’ to the system. This contrasts to many other countries which have ‘contributory’ systems, where workers with stronger work histories and higher earnings are entitled to higher benefits, at least for an initial period, when they lose their job in virtue of having paid in more. This means that an average single worker without children in the UK would (prior to the temporary UC increase) see their after tax and benefit income fall by 87% if they lost their job. Across the OECD as a whole, the average fall is just 45% for those who are entitled to contributory benefits – and even for those who are not, the average fall, while much higher at 80%, is still less than that seen in the UK.

Winners and losers

Paying a £500 bonus to current claimants instead of maintaining the temporary uplift would mean that those who become entitled to UC after the bonus is paid get neither the bonus nor the uplift. Precisely when one needs to be claiming UC to be eligible for the bonus is important here in the context of the furlough scheme being due to close at the end of April. If the bonus is only paid to those who are on benefits in March or at the start of April, then the (potentially significant) number of employees who lose their job when, or after, furlough closes would not be entitled. Similarly, someone whose income fluctuates over time meaning that they come on and off UC would miss out on the bonus if they are ineligible over the relevant period.

Those gaps in coverage could be partially ameliorated: the bonus could be paid to anyone who was on UC in April or makes a new claim for UC at some point in, for example, the next six months. Under such an approach, it would still be the case that anyone making a claim slightly too late would be ineligible in a way that would be arbitrary and unfair. But the problem would be smaller, since it would avoid excluding those who lose their job immediately following the closure of furlough.

More broadly, those who are on UC for more than half of 2021–22 would get a higher entitlement if the uplift was extended for at least that period than if the bonus policy, equivalent to about 6 months of the uplift, was instituted. Though it is worth noting that for those families who have been building up debts, falling behind on bills, or delaying purchases because of a lack of income might nonetheless prefer the bonus because it is paid all in one go early on, allowing them to meet these obligations.

The major winners from such a scheme would be those who are on UC at the relevant time to be eligible for the bonus, but who will be claiming UC for less than half the year. This could include someone who, for example, is out of work now but gets back into work before October 2021 (and is not eligible for UC when in work) – or even immediately following receipt of the benefit. In this way, the bonus policy is less well targeted at those who are on low incomes for longer periods.

How many winners and losers there are will crucially depend upon the progress of the labour market. The stronger the recovery the more winners there will be from the one-off payment relative to a temporary extension of the uplift. Families who do get back into work will also have been able to ‘smooth’ their consumption by more than would have been possible under the uplift extension. That said, a large one-off sum may also make budgeting over long periods more difficult than a steady stream. Communicating to claimants the fact that this is a one-off payment, rather than a vastly higher regular benefit entitlement, will also be crucial. There would be a strong case to pay the bonus separately from the usual benefit payment to reinforce this point.

Incentives and policy choices

The weakness of the labour market right now means that financial work incentives are not as important as usual – the constraint on employment is far more on the labour demand side than in what work people are willing to do. This is likely to be true for some time, but – hopefully – less so later in 2021 as some sort of recovery takes hold. The policy options do have different implications for work incentives. First, those who are out of work would have stronger incentives to be in work under the bonus policy after it is paid: since it is a lump sum, they do not lose it when they enter work. Second, the bonus policy creates perverse incentives to have a (potentially short) period of UC entitlement in order to get £500. This is probably easier for self-employed workers who could arrange their affairs to have a low income for one month, but perhaps possible for some employees too (for example they could temporarily undertake less paid overtime). This is obviously an undesirable aspect of the policy and hard to avoid under any lump-sum option.

Part of the motivation for the bonus policy is clearly political economy considerations: governments have, in many areas, time and time again, found that temporary policy reforms have had a tendency of being longer-lasting than intended: as Milton Friedman famously put it, “Nothing is so permanent as a temporary government program.” Tax and benefit policy is no exception, especially when their removal would lead to an individual seeing a cash fall in their income from one week to the next. By framing a further extension of extra support as a single lump sum ‘bonus’, the reduction in entitlement as we return to the previous system would be obscured. Conversely, extending the uplift for another year would be likely to create the similar pressures to extend again in 12 months’ time. It rather looks like the government really does not want to make this uplift permanent, and is trying to find politically smoother ways of achieving that.

A third option, if the uplift is not to be made permanent, would be to taper the £20 extension down steadily over the coming year. That would cost about the same amount as the bonus option, and still ensure that come April 2022 the temporary increase has been unwound. While it would, each month, create cash losses, they would be quite small (around £7 per month) and so perhaps more politically palatable. It would also avoid some of the difficulties of the one-off bonus policy listed above. Perhaps most importantly it would facilitate a more gradual adjustment for families – though one risk might be that it would be less than fully understood and thus make it more difficult for families to plan their budgets.

Conclusion

That the bonus policy is even on the table as an option suggests that the government believes two things. First, it believes that the temporary uplift should not be made permanent (or else it would just make it so). Second, it believes that it faces political constraints which would make a temporary extension difficult to reverse (or else it would presumably just announce that the uplift will be extended for a further period until the situation has returned to something sufficiently ‘normal’).

As for the first of these beliefs, whether or not the uplift should be made permanent is a political question about the appropriate generosity of the safety net and, as ever, there will be different views about the right answer. The UK does have an unusually thin out-of-work safety net, and there has been very little change in the entitlements of those without children over many years even when as a whole we have become much better off. This was known before the crisis, and evidently not deemed decisive by policy-makers at the time; though the past year has made this relatively minimalist safety net more widely appreciated, not least given that many families who never thought they would need it have experienced it first-hand. The government appears to have judged that nevertheless nothing relevant has changed in the longer term; or, perhaps, it may want to focus post-crisis benefit increases on other priorities such as patching up gaps in support for those left without it during this crisis.

As for the second of these beliefs, it may well be true. Past experience in policymaking on both taxes and benefits does suggest that there are significant political constraints in backing out of temporary giveaways once they become entrenched. The bonus policy would likely avoid that problem. It is also possible that it could be more helpful for those who are behind on bills or debt repayments, and it does not weaken incentives to get back into work after the bonus is paid, since the one-off payment would not be clawed back. But the political workaround would have some fairly messy effects too. It targets resources more towards those that are on a low income for a very short and specific period rather than more persistently or in a slightly different period, meaning that someone who becomes entitled to benefits slightly too ‘late’ will arbitrarily miss out on the bonus, and may create incentives for people to try to lower their income for one month to get the bonus.

Whatever the government decides, they ought to resolve the uncertainty one way or another as soon as possible. The sums here are significant: £20 per week represents 13% of an average recipient’s UC entitlement, and for some families the figure will be as high as 21%. Typically benefit recipients know what April’s benefit rates will be in the previous November or December. Waiting until the March Budget creates uncertainty and will make it difficult for low-income families to plan. A family currently deciding where they can afford to rent, for example, surely ought to know what their benefit entitlement will be in three months’ time.

We are thankful for funding from the Economic and Social Research Council (ESRC), as part of UK Research and Innovation’s rapid response to COVID-19, grant number ES/V00381X/1.