The local government finance system in England is undergoing genuinely revolutionary change. A highly-centralised system of funding, with central government grants allocated on the basis of councils’ relative spending need, is set to be replaced by a system where councils as a group are self-funding and individual councils bear far more spending and revenue risk. The aim of all this is to give councils stronger financial incentives to grow local economies and address underlying spending demand pressures. Accompanying this change will be simplified powers for councils to cut business rates. Decentralisation will be incomplete though – central government plans to keep a tight rein on councils’ ability to increase council tax and business rates bills. In Scotland and Wales, little has changed so far, but the next few years could see significant reforms to local tax bases.

This is the first report in a new multi-year IFS research programme examining these major changes to local government finance. The programme will consider the impacts of changes so far, provide in-depth analysis of the main issues related to upcoming reforms, and consider the opportunities (and challenges) that would arise from greater fiscal devolution. This report provides an initial look at the changes in councils’ spending, funding and funding systems since 2010, and highlights some of the key issues for the planned shift to 100% retention of business rates revenues by councils in England.

On council spending it finds that:

- Excluding education spending, councils in England plan to spend around 22% less on service provision in 2016–17 than they did in 2009–10.

- Cuts in Scotland and Wales, at 15% and 11.5% respectively, have been smaller. This is partly because of the devolved governments’ decisions to protect health spending to a lesser extent than in England allowing smaller cuts to other areas. And in Wales’ case council tax bills have risen substantially more than in England.

- In England, cuts have been much larger for poorer, more grant-dependent councils than their richer neighbours, who can raise more of the money they need via their own council tax revenues. This pattern arose directly from the way central government allocated grants. Tweaks made between 2011-12 and 2013-14, which were supposedly intended to mitigate this, were largely ineffective. They were abandoned in 2014–15 and 2015–16.

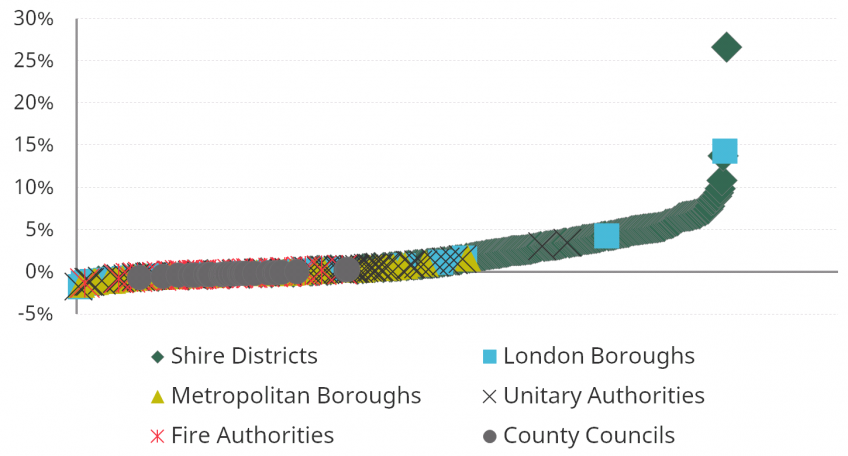

On the Business Rates Retention Scheme, which currently allows local areas to keep up to 50% of the growth in business rates revenues, it finds that:

- 52 (mostly district) councils are forecast to see their overall funding boosted by 5% or more by the scheme between 2013–14 and 2016–17, compared to what they would have received if business rates had been pooled and the amount received by each council had instead increased in line with national growth in business rates revenues.

- On the other hand, 119 councils, including most county councils and metropolitan boroughs, will be relative losers under the scheme, though none will have lost more than 2% of their funding.

As part of truly revolutionary reforms to local government in England, by 2020 councils will retain 100% of business rates revenues:

- This will provide a stronger financial incentive for growth but also mean more budgetary risk: councils’ potential gains will be larger, but so too will their potential losses. Greater funding divergence could lead to greater divergence in council service quality across England;

- If it works like the current system, some councils could gain and others lose significant sums, even if business rates revenues grow at the same rate across all councils. This rather counter-intuitive outcome could be addressed via some simple technical changes to the way the scheme works, without blunting the financial incentives for growth it is meant to provide.

Figure: Relative gains and losses as a result of the business rates retention (2013–14 to 2016–17), expressed as a percentage of councils’ overall funding

The presentation given at the event can be found here.