In Budget 2016 the Chancellor announced a 'soft drinks industry levy' due to take effect from April 2018. The charge will be levied on soft drinks that contain added sugar and is aimed at “help[ing] tackle childhood obesity.”

New analysis by IFS researchers, published as an IFS Briefing Note today, shows over 90% of households purchase more than the recommended share of their calories as added sugar and carbonated and non-carbonated soft drinks account for 17% of added sugar purchases. Households with children obtain around 50% more of their added sugar from soft drinks, compared with households with no children. In addition, households that purchase larger amounts of sugar overall tend to buy a higher share of their added sugar as carbonated and non-carbonated soft drinks. Comparing the top 20% and the bottom 20% of households based on their share of calories from processed added sugar, households that purchase the largest amounts of sugar get around twice as much of their sugar from carbonated and non-carbonated soft drinks as households that purchase the lowest amounts of sugar.

The case for government intervention to reduce sugar intake is that there are costs associated with consumption that are not taken into account by the individual when choosing what to eat. As is the case with alcohol consumption, these costs include publicly funded health costs of treating diet-related disease or unanticipated future health problems. In the case of sugar these costs are likely to be most severe for children and for people who consume a lot of sugar. Given that these groups get a relatively high share of their sugar from soft drinks the soft drinks industry levy looks to be reasonably well targeted.

The effectiveness of the tax in reducing sugar intake will depend on how strongly people switch from the products that are taxed, and, crucially, what products they switch to buying instead. The levy will not apply to fruit juice, milkshakes, chocolate or confectionery. If consumers respond to higher soft drink prices by switching to these alternatives then the impact of the tax on sugar intake may be partially offset. Exemptions from the levy have been promised for small operators. The justification for this is unclear and could potentially lead to an increase in small producers offering high sugar products that escape the tax. In addition, how the major producers and retailers of soft drinks respond will be important. It is unclear how much of the tax will be passed-through to consumer prices. The extent to which manufacturers “reformulate by reducing the amount of added sugar in the drinks they sell” is also uncertain and will be important.

A tax on the sugar in soft drinks targets only one source of added sugar; a broader based tax on all sources would likely lead to larger reductions in dietary sugar. However, such a tax would potentially be more complicated to implement. There may also be concerns that some foodstuffs on which the tax would fall provide other important nutrients. That is not a concern with a tax on soft drinks. It is worth noting though that, along with biscuits and confectionery, soft drinks are among the few foodstuffs that are already subject to VAT. The continued zero rating for VAT purposes of cakes and other sugary foods remains as an effective tax subsidy to their consumption.

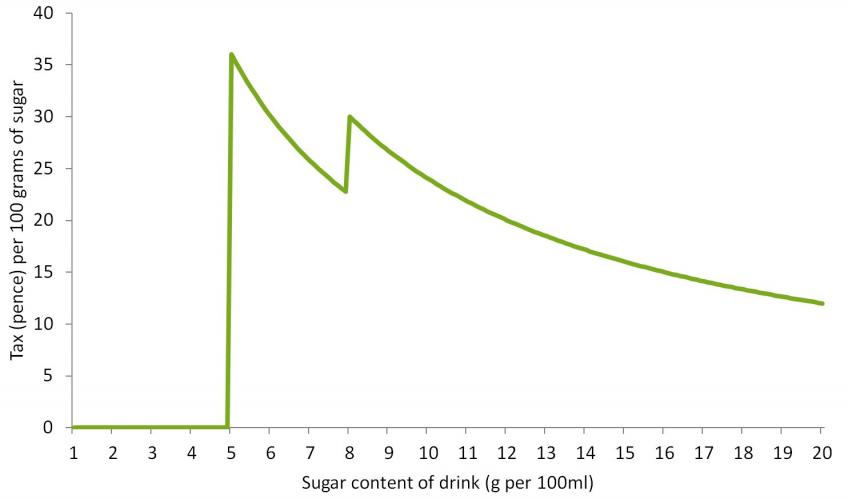

None of this is to suggest that a tax on sugary drinks is necessarily a bad idea. The structure of the tax should be carefully designed though. A sensible starting point would be to directly tax the sugar content of targeted products. The announced soft drinks industry levy does not do this. The government have set a specific revenue target, which the OBR has computed as corresponding to a rate of 18 pence per litre for drinks with 5-8 grams of sugar per 100 millilitres, and a higher rate of 24 pence for drinks with more than 8 grams of sugar per 100 millilitres. This means that, in many cases, the tax per gram of sugar is declining in the amount of sugar per 100 millilitres in a product – see Figure 1. This creates unnecessary anomalies – for instance a 1 litre product that contains 100g of sugar will attract the same amount of tax overall, and only two thirds as much per 100 grams of sugar, as a 1 litre product containing 50% more sugar.

The new soft drinks industry levy is not scheduled to come into effect until April 2018. This gives the chancellor time to adjust the structure of the tax to make sure it better targets the sugar content of products.

Figure 1: Soft drinks industry levy by drink sugar content

Note: We gratefully acknowledge financial support from the European Research Council (ERC) under ERC-2009-AdG grant agreement number 249529 and the Economic and Social Research Council (ESRC) under the Centre for the Microeconomic Analysis of Public Policy (CPP) grant number ES/M010147/1 and under the Open Research Area (ORA) grant number ES/I012222/1.