Today the Office for National Statistics and HM Treasury published Public Sector Finances January 2015. We now have details of central government receipts, central government spending, public sector net investment, borrowing and debt for the first ten months of financial year 2014−15.

Soumaya Keynes, a Research Economist at the IFS, said:

“Today’s figures indicate that the government enjoyed a strong surplus in January 2015, with total revenues exceeding public spending by £8.8billion. In part this was driven by strong growth in VAT and corporation tax receipts, which has helped to offset the fact that receipts from self-assessment income tax, while stronger than January 2014, appear to have been weaker than expected by the Office for Budget Responsibility in December. Over the year so far overall tax receipts and overall public spending have grown broadly as expected by the OBR for the year as a whole. Borrowing this year therefore looks likely to come in close to the £91.3 billion forecast by the OBR.”

Headline Comparisons

Central government current receipts (excluding the asset purchase facility) were forecast to increase by 3.5% between 2013–14 and 2014–15 by the Office for Budget Responsibility (OBR) in its December 2014 EconomicandFiscalOutlook. This forecast implies that revenues are expected to be 4.3% higher during the last five months of the financial year (November 2014 to March 2015) than in the same months last year.

Today’s figures suggest that receipts in January 2015 were 4.3% higher than in January 2014, in line with the OBR’s forecasts for the final five months of the financial year. For the year to date, the receipts outturns are also in line with the OBR’s forecast of 3.5% growth for the year as a whole.

Within the total, however, not all taxes are performing as well as was expected back in December 2014. The OBR was expecting strong growth in January’s receipts from self-assessment income tax and capital gains tax. These receipts appear to have disappointed relative to expectations, but this has been offset by stronger than expected growth in other receipts.

Central government current spending was 0.1% lower in January 2015 than in the same month last year. Over the first 10 months of 2014–15, spending has been 1.4% higher than over the same months in 2013–14. This is lower growth than was expected by the OBR back in December 2014, which was for growth of 1.6% over the year as a whole and 1.4% growth during the final five months of the financial year relative to the same months of last year.

Public sector net investment totalled £3.4bn in January 2015, which was £0.7bn more than was spent in January 2014. Public sector net investment between April 2014 and January 2015 was £19.2bn, which is 10.2% higher than in the same ten months of 2013−14. The OBR’s latest forecast was that net investment in 2014–15 would be £27.7bn, or 7.5% above last year’s level.

What would happen if these trends continued?

- Public sector net borrowing during the first 10 months of 2014−15 was £74.0bn, which is 7.5% (£6.0bn) lower than the amount borrowed during the same period last year. If this rate of decline were to continue for the remainder of this financial year, borrowing for the whole of financial year 2014−15 would be about £90.0bn, £7.3bn less than was borrowed in 2013–14. This fall in borrowing would be slightly larger than the £6.0bn fall forecast by the OBR in its December 2014 Economic and Fiscal Outlook.

Important figures this month

- January is an important month for the public finances, as around a quarter of all revenues from corporation tax are paid in that month. Corporation tax receipts so far this year have risen more quickly than the OBR expected: on a cash basis they been 6.5% higher over the first ten months of 2014–15 than over the same months in 2013–14. This is much faster growth than the 3.9% forecast by the OBR for the year as a whole; if current trends were to continue, then corporation tax receipts might come in as much as £1 billion higher than was expected by the OBR in December.

- This January was a particularly important month for self-assessment income tax receipts. The OBR was expecting strong growth due to individuals shifting income to avoid the 50p top rate of income tax. However, while self-assessment income tax receipts in January 2015 were substantially higher than in the same month of 2014, they were not as high as was expected by the OBR at the time they made their December forecasts. The outturn of a 15.6% increase since last January compares to a forecast 22.9% increase for the last five months of 2014–15. However, this year the deadline for submitting one’s self-assessment tax receipts fell on a Saturday, which means that there is a chance that an unusually large proportion of self-assessment income tax receipts may arrive in February. Next month’s data will give a better idea of what has happened to this tax.

Further Analysis

Information is now available for the first ten months of financial year 2014−15. Figures for receipts and spending in January 2015 show:

Central government current receipts

Accrued receipts from Income Tax, Capital Gains Tax and National Insurance Contributions for January 2015 were 5.0% higherthan in the same month last year. The OBR’s December 2014 forecasts imply that the receipts from these taxes will be 3.1% up on last year’s levels over the whole year and 4.6% up over the period from November 2014 to March 2015. Together, the receipts for these taxes during the first ten months of 2014−15 were 2.8% higherthan those for the same months of 2013−14, while receipts for the period November 2014 to January 2015 were 4.7% higher than over the same period in 2013−14.

Cash Corporation Tax receipts for January 2015 were 12.1% higherthan the same month last year. The OBR’s December 2014 forecasts imply that the receipts from this tax will be 3.9% up on last year’s levels over the whole year and 3.2% up over the period from November 2014 to March 2015. Corporation Tax receipts during the first 10 months of 2014−15 were 6.5% higher than in the same months of 2013−14, while receipts for November 2014 to January 2015 were 11.1% higher than the same three months of 2013−14.

Accrued receipts of VAT in January 2015 were 2.1% higher than the same month last year. Together, accrued VAT receipts during the first ten months of 2014−15 were 4.0% higherthan those for the first ten months of 2013−14, while receipts for November 2014 to January 2015 were 3.2% higher than the same three months of 2013−14. The OBR’s December 2014 forecasts imply that the receipts from this tax will be 3.1% up on last year’s levels over the whole year and 1.3% up over the period from November 2014 to March 2015.

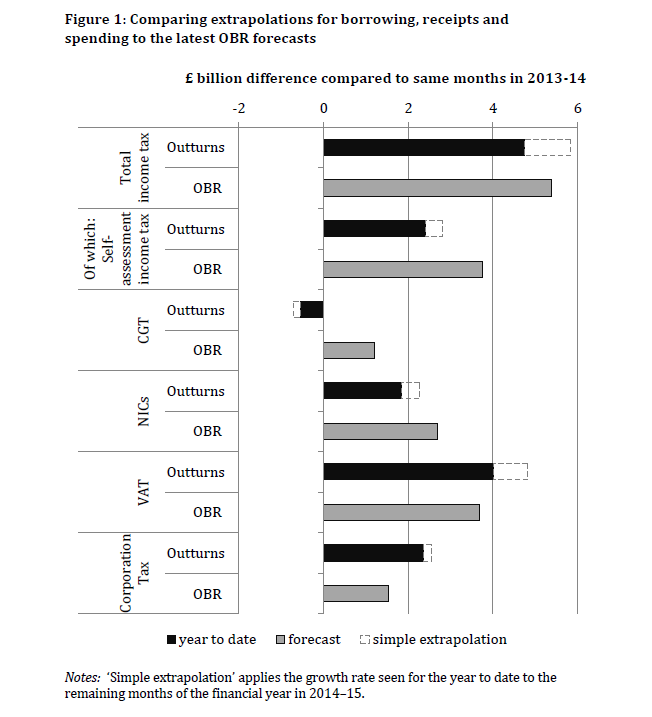

Figure 1 below shows the implied £bn change in receipts over the year to date, with a simple extrapolation for the final two months of the year. The grey bars show the increase implied by the OBR’s December forecasts for each tax. Comparing the bars shows which of the major taxes have been underperforming and overperforming relative to expectations back in December. It shows how self-assessment tax receipts and NICs have been increasing less quickly than expected, though this has been offset by growth in PAYE income tax, VAT and Corporation tax.

Central government current spending

Expenditure on net social benefits was 1.5% higher in January 2015 than in January 2014. Expenditure during the first ten months of 2014−15 was 2.6% higher than in the same months of 2013−14, while spending in November 2014 to January 2015 was 2.4% higher than in the same three months of 2013−14. The latest OBR forecast implies that this spending will be 3.1% up on last year’s levels over the whole year, and 3.7% up over the period from November 2014 to March 2015.

Spending on debt interest was £2.9bn in January 2015, £0.8bn less than in January 2014. Total spending on debt interest between April 2014 and January 2015 was £30.2bn. In December 2014, the OBR forecast that total debt interest spending by central government in 2014–15 would be £48.1bn.

Other current spending by central government, including spending on the delivery of public services, was 1.4% higher in January 2015 than in January 2016. Expenditure between April 2014 and January 2015 was 1.1% higher than in the same months of 2013−14, while spending between November 2014 and January 2015 was 0.6% higher than the same months in 2013−14. The OBR’s December 2014 forecast implies that this spending will be 1.2% up on last year’s levels over the whole year and 1.0% up over the period from November 2014 to March 2015.

In January 2015 public sector net investment was £3.4bn, £0.7bn more than was spent in January 2014. So far in 2014−15, a total of £19.2bn has been spent on public sector net investment, compared to the £17.4bn that had been spent by the same point in 2013−14. The latest OBR forecast is that net investment in 2014−15 will be £27.7bn, which is 7.4% above last year’s level.

Further information and contacts

For further information on today’s public finance release please contact: Soumaya Keynes or Gemma Tetlow on 020 7291 4800, or email [email protected] or @email.

Next month’s public finances release is due to be published on Wednesday 21st March 2014.

Relevant links:

This, and previous editions of this press release, can be downloaded from http://www.ifs.org.uk/publications/browse?type=pf

Office for National Statistics & HM Treasury, Public Sector Finances, January 2014: http://www.ons.gov.uk/ons/rel/psa/public-sector-finances/january-2014/stb---january-2014.html

Office for Budget Responsibility analysis of monthly Public Sector Finances, January 2014: http://budgetresponsibility.independent.gov.uk/category/topics/monthly-public-finance-data/

Useful links and background information on Autumn Statement 2013 can be found at: http://www.ifs.org.uk/projects/423

Office for Budget Responsibility, Economic and Fiscal Outlook, December 2013: http://budgetresponsibility.org.uk/economic-fiscal-outlook-december-2013/

HM Treasury Autumn Statement 2013: https://www.gov.uk/government/topical-events/autumn-statement-2013

Notes to Editors:

- Central government current spending includes depreciation.

- Where possible we compare figures on an accruals basis with the Office for Budget Responsibility forecast.