In work funded by the Office of the First Minister and Deputy First Minister in Northern Ireland, the IFS today published an update of our previous income projections for Northern Ireland and for the UK as a whole. This observation draws out what this research tells us about the likely path of household incomes in the UK in the next few years.

Throughout this observation, we focus on changes in incomes relative to inflation as measured by the CPI. Official government statistics still used the flawed RPI measure of inflation; figures using this measure are shown in the briefing note.

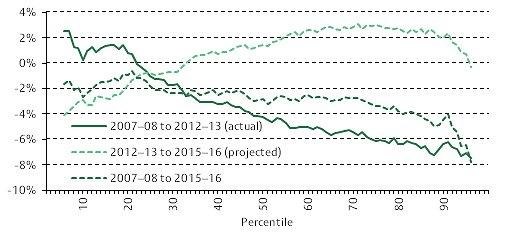

Unsurprisingly, the recent recession had a significant impact on household incomes. Median (middle) income fell by 5% relative to CPI between 2008–09 and 2011–12, before growing slightly in 2012–13, the latest year for which official statistics are available. Our projections show that median income is likely to have fallen again relative to CPI in 2013–14, but might now be growing (slowly) in real terms. This means that we expect median household income in 2015–16 to be roughly where it was in 2010–11 (after adjusting for CPI inflation), though still about 3% below its 2007–08 level.

These trends in median income tell us nothing about what is going on at higher or lower income levels. During the recession, income inequality fell as state benefits broadly retained their real value due to price indexation, while workers’ earnings failed to keep pace with CPI inflation. Tax rises affecting better-off households also played a role in reducing inequality. However, this does assume that all households face the average inflation rate - previous IFS research has shown that lower-income households were experiencing higher rates of inflation than richer households over this period. In addition, our projections show that this pattern of income changes is likely to be reversing now: cuts to working-age benefits were accelerated in 2013–14 and will continue to accumulate until at least 2015–16, while earnings growth starts to recover and middle- and higher-income households benefit most from large increases in the income tax personal allowance. As we show in our report, the fact that the incomes of low-income households are projected to fall between 2012–13 and 2015–16, both relative to CPI inflation and median income, means that we would expect both absolute and relative poverty measures to increase over this period.

It is important to note that our projections rely on forecasts for the macroeconomy produced by the Office for Budget Responsibility. A new set of these forecasts will be produced alongside the Autumn Statement next week. Changes to these forecasts – for example, if earnings growth is once again downgraded, or inflation is lower – will have an impact on our projections. We will therefore be updating our projections as part of our election analysis next year.

Figure 1. Real income growth by percentile point: 2007–08 to 2015–16

Note: Figures adjusted for CPI inflation.